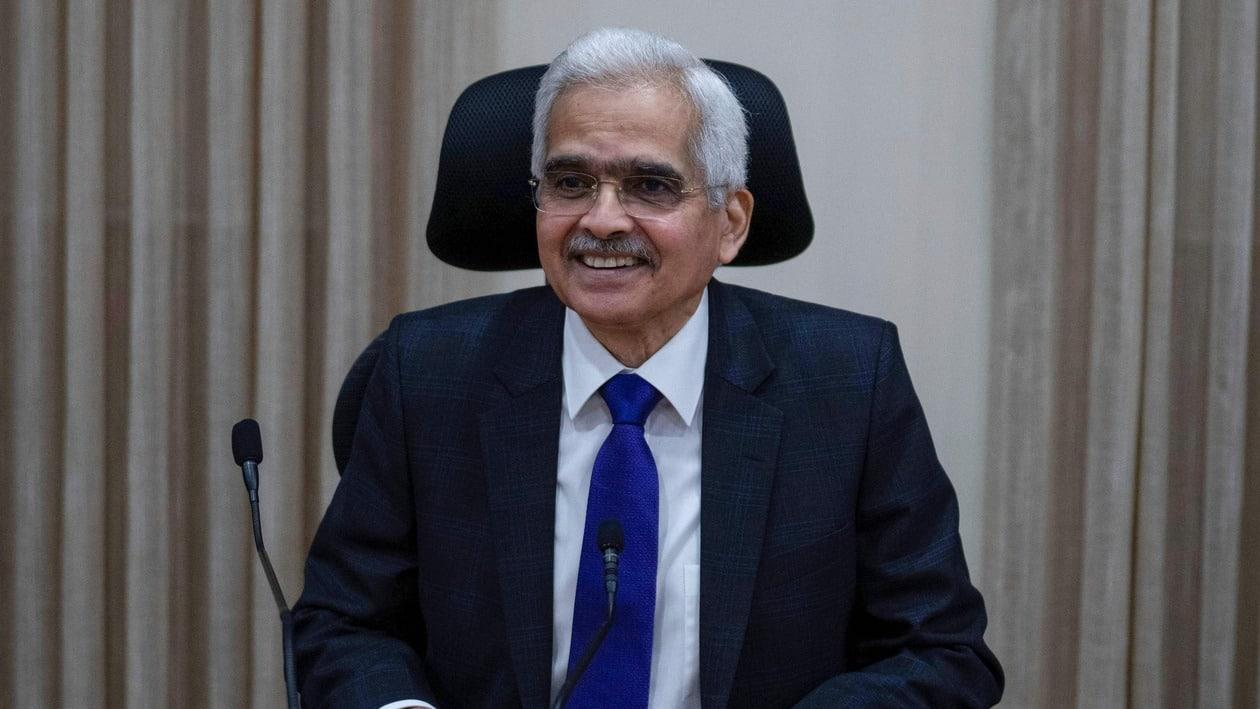

Reserve Bank of India (RBI) governor Shaktikanta Das has said that the central bank is well aware of the global challenges and is prepared to defend the country's financial stability.

"We recognise the destabilising potential of global risks, even as we draw strength from the robust macroeconomic fundamentals of the Indian economy. The Reserve Bank and the other financial regulators remain vigilant and in readiness to ensure the stability and soundness of our financial system through appropriate interventions, whenever necessary, in the best interest of the Indian economy," Das said in the foreword to RBI’s half-yearly Financial Stability Report (FSR) published on December 29.

“The international economic order stands challenged; financial markets are in turmoil due to monetary tightening in most parts of the world; food and energy supplies and prices are under strain; debt distress is staring at many emerging markets and developing economies; and every economy is grappling with multiple challenges," added Das.

The governor said the Indian economy presents a picture of resilience amid all challenges.

"Financial stability has been maintained. Domestic financial markets have remained stable and fully functional. The banking system is sound and well-capitalised. The non-banking financial sector has also withstood these challenges," he said.

According to him, banks are able enough to withstand even severe stress conditions, should they materialise. Furthermore, in spite of formidable global headwinds, India’s external accounts remain well-cushioned and viable.

Earlier this month, the RBI highlighted the risk of sticky inflation in the December 2022 issue of its monthly Bulletin.

The RBI said inflation would likely moderate in 2023 from current levels, but it would remain well above targets in most economies.

"With every passing day, the balance of risks gets increasingly tilted towards a darkening global outlook for 2023, the year that will bear the brunt of monetary policy actions of this year. Emerging market economies (EMEs) appear to be more vulnerable, even though incoming data suggest that global inflation may have peaked," said the RBI.

The central bank, however, underscored that the current growth momentum in the Indian economy is likely to sustain because of easing input costs pressures, upbeat corporate sales and growing investments in fixed assets.