(Bloomberg) -- Global funds haven’t been this optimistic about emerging Asia ex-China stocks in almost two years. Whether this lasts will depend on the US policy signals that emerge today.

Overseas investors poured a net $7.5 billion into nine regional markets so far in August, the biggest monthly inflow since end-2020, according to exchange data compiled by Bloomberg. India accounted for the lion’s share as foreigners pumped in $5.7 billion, while South Korea received $2.3 billion.

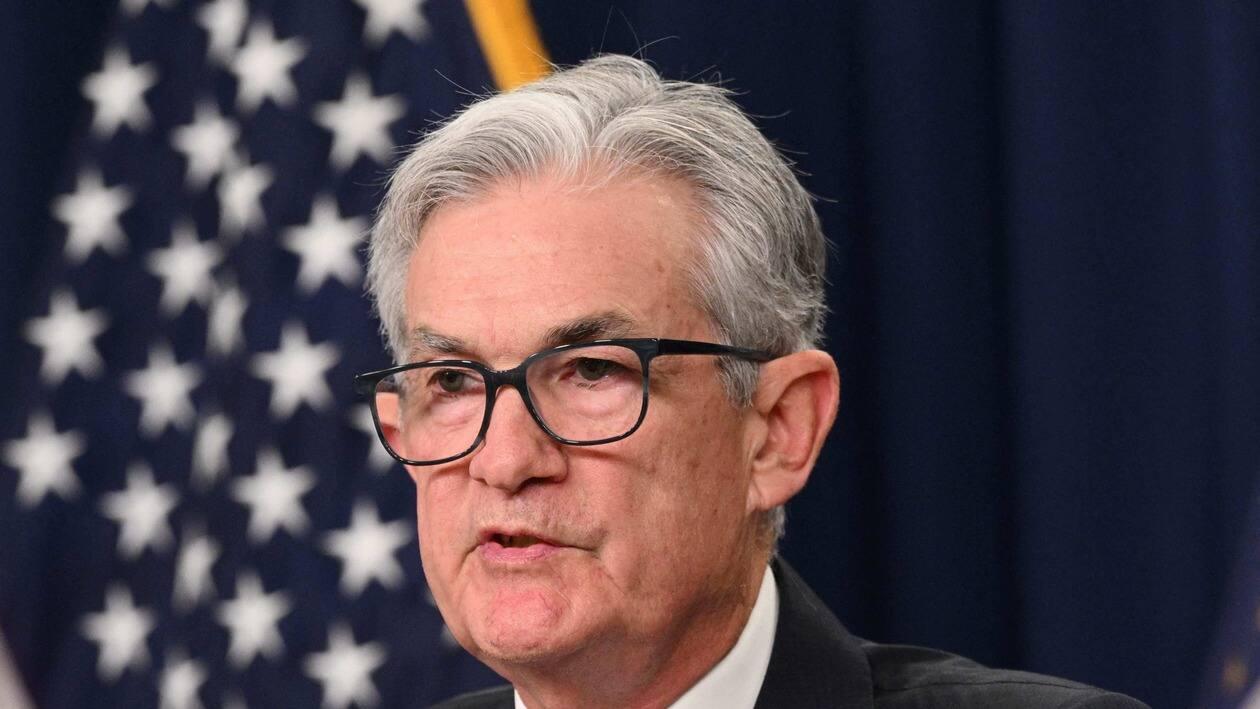

The wave of buying mirrors a similar dash into developing Asian bonds, and this investor optimism will be tested when Jerome Powell sets out the path for US policy on Friday. Inflows may dry up if the Federal Reserve Chair signals a determination to press on with aggressive rate hikes to curb inflation.

Powell’s remarks are likely to help define the path for emerging Asian stocks, which are languishing near a two-year low. Concerns that rising interest rates may tip the global economy into a recession have eroded demand for equities.

For now, the wave of inflows is fueling hope of more buying, especially in the case of India where funds are returning after a record $33 billion exodus between October and June. An improving outlook for the economy and corporate earnings is boosting confidence, and the market’s relative appeal has also increased as China struggles with a property crisis and sporadic Covid lockdowns.

“A trend reversal has emerged in the case of Indian equities, as FIIs turned net buyers in July after nine months of relentless selling,” Herald van der Linde, head of APAC equity strategy at HSBC Holdings Plc, wrote in a note on Thursday.

More broadly, funds that have a mandate to invest in Asia are rotating toward underweight markets from overweight ones, according to HSBC’s analysis.

“Over the past month, these funds appear to have trimmed exposure to Asean, Korea, and Hong Kong equities to add to markets where they are underweight, such as mainland China, India and Taiwan,” Linde wrote.