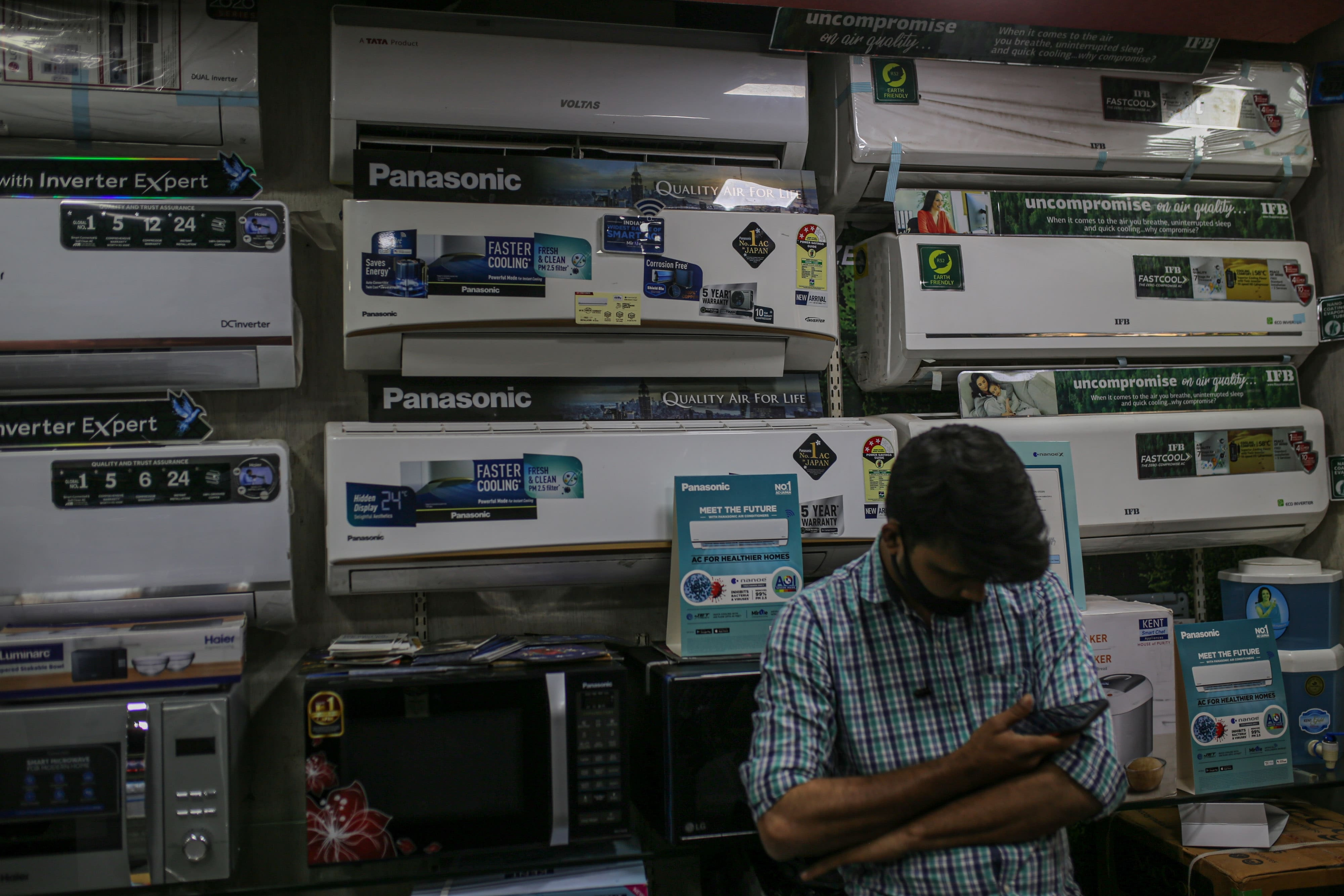

Since the beginning of 2022, there have been lots of challenges for the consumer durables sector, starting from the war, high commodity prices, the COVID situation and lockdown in China, and the rupee falling to an all-time low. However, demand for summer products has improved two years after being wiped out due to COVID-19-induced lockdowns impacting the sales of refrigerators and air conditioners.

Consumer durables stocks have fallen 20-30% since the start of the year; Here is why

Due to high commodity price pressure (steel/aluminium/copper), companies have taken multiple price hikes since the start of the year, and now with the rupee hitting an all-time low, the imported components will become more expensive.

Due to high commodity price pressure (steel/aluminium/copper), companies have taken multiple price hikes since the start of the year, and now with the rupee hitting an all-time low, the imported components will become more expensive as the industry is more dependent on imports for key components.

Adding to the challenges, increases in interest rates will likely push the EMIs (equated monthly instalments) of customers who buy consumer goods by taking loans. So far, cash-back offers and zero-cost EMIs are some of the reasons behind the good demand for electronic products, but this is soon set to change with rising interest rates.

As rates go up, it will increase the cost of capital for companies and in turn push the product prices higher, leading to high EMIs.

From the start of 2022, shares of the consumer durables sector have lost their value by around 20–30%. Moreover, half of the stocks in the sector are creating new 52-week lows.

Higher raw material costs pulled down companies' gross margins in the March quarter. In fact, most stocks have fallen by around 10% since the results were announced.

| Company Name | LTP (Rs) June 15 closing | 52 week Low | Previous 52 week Low Date | % Distance from 52 week low |

| Crompton Greaves | 317.80 | 313.35 | 14 Jun 22 | 1.42% |

| Vaibhav Global Ltd | 332.1 | 325.30 | 13 Jun 22 | 2.11% |

| Amber Enterprises India Ltd. | 2,227.3 | 2,155.0 | 09 Jun 22 | 3.35% |

| Rajesh Exports | 539.20 | 518.50 | 07 Jun 22 | 3.39% |

| Voltas | 996.85 | 922.55 | 16 May 22 | 8.05% |

| Dixon Technologies | 3,472.0 | 3,180.55 | 16 May 22 | 9.16% |

| Bajaj Electricals Ltd. | 941.40 | 860.60 | 12 May 22 | 9.39% |

Crompton Greaves

Shares of Crompton Greaves Consumer Electricals Ltd. ended at Rs. 317.80, (up 0.11%) on the BSE in Wednesday's trade. The stock hit a 52-week low of Rs. 313.4 in today's trading session.

The stock has fallen 38.02% from its 52-week high. In the last six months, the stock gave a negative return of 26.56%. Year to date, it is down 28.25 per cent.

The company's ROE has consistently declined in the last 5 years. The majority of profits last year were disbursed as dividends to shareholders.

The stock quoted a price-to-earnings (PE) ratio of 34.62, earnings per share (EPS) of ₹9.13, and a price-to-book value (PB) of 6.67, while the return on equity (ROE) stood at ₹23.57.

Promoters held a 5.94 per cent stake in the company as of 31-Mar-2022, while FIIs held 48.58 per cent and MFs 32.08 per cent.

Vaibhav Global Ltd

In Wednesday's trade, Vaibhav Global's share price declined 0.15 to Rs. 331. The stock had made a new 52-week low in the past 7 days.

The stock's 52-week high and low levels were Rs. 325.3 apiece and Rs. 860 apiece, respectively. Taking the present price into account, the stock has plummeted 61.33 per cent from its 52-week high.

Since its March quarter result announcement, the share price has fallen 15%.

The company's EBITDA fell 44.7% to ₹47 crore in Q4 FY22 from ₹47 crore in Q4 FY21. EBITDA margin fell from 12.8% in Q4 FY21 to 6.9% in Q4 FY22.

Profit before tax (PBT) for Q4 FY22 stood at ₹25.01 crore, down by 65.4% from the ₹72.18 crore reported in Q4 FY21.

Total expenses jumped 10.6% year on year to ₹650.13 crore in the quarter ended March 31, 2022.

On a full-year basis, the company reported a 12.5% decline in consolidated net profit to ₹237.71 crore despite an 8.4% rise in net sales to ₹2,752.43 crore in the financial year ended March 31st 2022 over the financial year ended March 31st 2021.

Rajesh Exports

Rajesh Exports shares have declined 28.36 per cent so far in 2022. The stock has dropped 45.81% from its 52-week high and with Wednesday's closing price of Rs.546, the stock is just 3.99% away from its 52-week low.

The scrip over the last three years has declined 21.9 per cent as compared to a 55 per cent rise in the Nifty Midcap 100.

It has a market capitalization of Rs. 15,840.70 and the company had a price to book value of 1.24.

The stock's beta value, which measures volatility in relation to the broader market, stood at 0.58.

Meanwhile, company sales de-grew by 5.86%. It witnessed revenue contraction for the first time in the last 3 years.

Voltas

Voltas Limited, a division of the Tata Group, is India's No. 1 room air conditioner brand, with a market share of more than 24 per cent.

The company’s Q4 performance was hit by lower EMPS revenues and a sharp decline in the profitability of the UCP segment.

The EBITDA margin fell 268 basis points year on year to 9.8%, owing to high raw material costs. The gross margin fell by 278 basis points year on year. The margin of unitary cooling products (UCP) dipped 522 bps to 10.6%.

Voltas stock has dropped 13% since its Q4 earnings announcement.

The stock touched its 52-week low of ₹922.35 on May 16, 2022, and with Wednesday's closing price of Rs.994, the stock is just 8.05% away from its 52-week low.

However, over the past three years, the market price of the stock has zoomed by 64.79 per cent.

Promoters held a 30.3 per cent stake in Voltas Ltd. as of March 31st, 2022. Mutual funds and foreign institutional investors held 17.5 per cent and 26.19 per cent stakes, respectively.

Bajaj Electricals

Shares of Bajaj Electricals have fallen 11% since its Q4 results announcement. Further, the stock has dropped more than 26.7% so far in 2022.

In Wednesday's trade, Bajaj Electricals' share price declined 1.4% to Rs. 938.90/share.

At its prevailing price, the stock traded at 83.91per cent times its trailing 12-month EPS of ₹11.19 per share and 6.47 times its book value.

The stock's 52-week high and low levels were Rs.860 apiece and Rs.1,589 apiece, respectively. If today's price is taken into consideration, the stock has so far fallen 40.60% from its 52-week high.

For the fourth quarter ended March 2022, the company reported a 28.73 per cent decrease in consolidated net profit at Rs. 38.67 crore.

Bajaj Electricals reported being net debt-free at a consolidated level as of March 31st for the first time in four decades.

Will the buy the dip work?

"Buying the dip" is a way of purchasing a stock or an index after it's fallen in value. So, after losing 20–30% of their value, will this work for consumer durables stocks? Most of the consumer durable sales come from the rural market, and when consumers have high purchasing power, they prefer to buy such big-ticket items. But now the situation is different. The demand is slowing due to the rising cost of living and high-interest rates. During these tough periods, consumers only spend money on necessities. Families cut back or postpone their purchases for some time or until they feel financially secure. If this occurs, demand for these products will drop. And when there isn't enough demand in the market, companies can't keep raising prices. Margins will be eroded if this occurs and finally impact share prices.