Shares of Finolex Cables soared 17% to mark a new 52-week high in Wednesday's trade. The stock had a good start to the trading session, opening at ₹608 apiece, compared to the previous close of ₹597.80 and maintained the same momentum throughout the trade, reaching a new 52-week high of ₹700 before closing the session higher at ₹671.60, up 12.35%.

The stock has been on a bull run since February 9, 2023, after the company reported a 42% YoY jump in its standalone net profit at ₹135 crore for Q3FY23. It has produced a return of 22.55% during the period.

The company's net profit was driven by strong operating performance, aided by higher other income. The operating profit during the quarter came in at ₹141 crore, an increase of nearly 30% YoY, while the EBITDA margin expanded by 111 basis points to 12.3%.

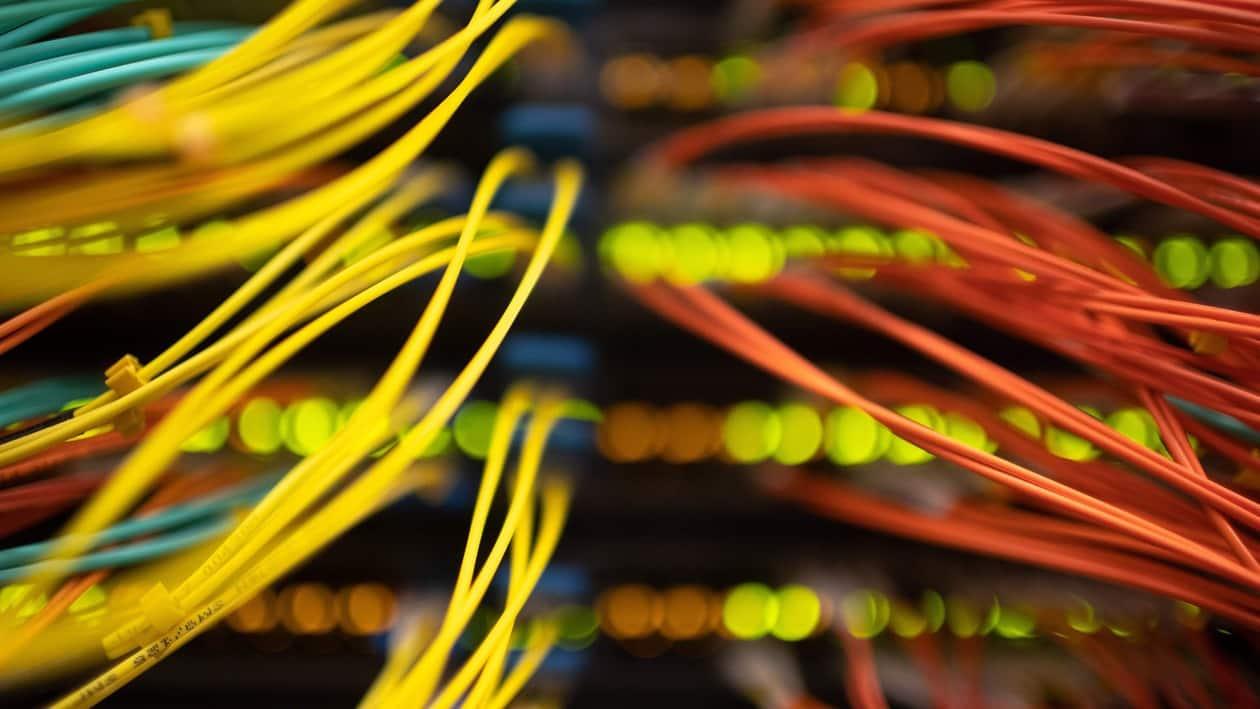

Finolex Cables, which is a leading manufacturer of electrical and telecommunication cables in India, clocked a revenue of ₹1,150 crore for the October-December quarter of FY23, a surge of 18.19% YoY and 5.40% QoQ.

The electric cable division, which accounts for more than 80% of the company's revenue, posted a growth of 14.6% YoY to ₹947 crore. While the communication cable sales were up 60% YoY to Rs. 147 crore, the sales of copper rods increased to ₹321 crore in Q3 FY23.

In volume terms, the electric cables segment witnessed a volume growth of 24%, and in OFC (optic fibre cable), volume grew by over 70% during the quarter.

Domestic brokerage firm Sharekhan stated that the company's performance has improved considerably in Q3 FY23, with strong sales and margin expansion at the gross as well as operating levels. This was driven by strong volume-led growth owing to sustained demand and declining commodity prices, it added.

Demand for electric cables is likely to be strong in the construction and real estate sectors. Further, momentum in the industrial and automobile industries is also positive, it says.

The company’s FMEG (Fast-Moving Electrical Goods) business would grow with an improving demand environment. In the FMEG space, the company aims to reach a revenue of Rs. 500 crore over the next two years, said the brokerage.

Sharekhan is bullish on the company's optical fibre cable division, as the government’s push and telecom players’ capex will support the business and boost demand for the company’s communication cables.

“Finolex's debt-free balance sheet and strong cash position provide us comfort. The company’s focus on strengthening its dealer/distributor channels across geographies and enhancing its product availability is likely to yield the desired results,” the brokerage said.

The company also has the opportunity to increase market share organically, as the pandemic has had a severe impact on unorganised sector players.

The brokerage noted that the pickup in capex in real estate, construction, industrials, and the auto sector post COVID-19 is likely to lead to robust demand for housing wires and cables.

In addition to that, the ongoing government programmes (Bharat Net Phase) are expected to improve broadband connectivity and related technologies, which will continue to drive growth for communication cables, it stated.

7 analysts polled by MintGenie on average have a 'strong buy' call on the stock.

Disclaimer: The views and recommendations made above are those of individual analysts or broking companies, and not of MintGenie.