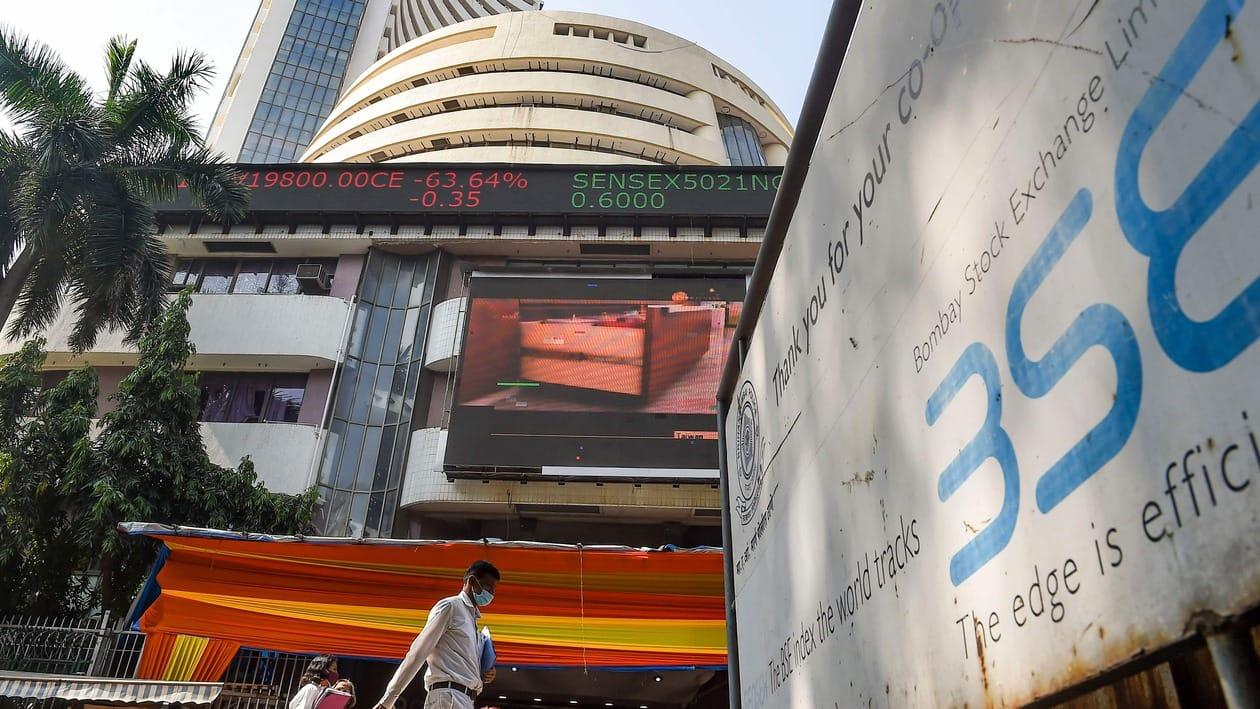

After a decline of around 5 percent in June, Indian markets recovered a bit in July. So far, the domestic indices have advanced over 3 percent in the current month.

According to a recent report by global brokerage Credit Suisse, Indian equity markets are likely to withstand inflation up to 8 percent. However, it added that if inflation moved higher than this, the valuation of Indian equities could deteriorate further.

In June, India's headline retail inflation rate, as measured by the Consumer Price Index (CPI), came in at 7.01 percent, a slight recovery from 7.04 percent in May 2022. This is the sixth consecutive month that the CPI data has breached the Reserve Bank of India's (RBI) upper margin of 6 percent.

The brokerage continues to believe that India’s valuation relative to its emerging market (EM) peers could stay elevated and that this valuation premium is justified, given the country’s improved fundamentals and a solid structural growth outlook from a medium-term perspective.

"Based on our analysis, the Indian economy and the equity market should be able to withstand inflation up to 7 percent – 8 percent. Should the rate of inflation move higher, we could see valuations of Indian equities deteriorate further," the note added.

It further pointed out that the recent decline in the markets has seen Nifty’s 12-month forward price-to-earnings (P/E) ratio of 17.6 fall towards its 10-year and the 5-year average of 16.9, which suggests that the valuation froth of Indian equities has settled.

Going ahead, Credit Suisse expects markets to be focused on corporate earnings for the June quarter.

It believes that the June quarter earnings are likely to be under pressure on the back of weak consumer confidence due to aggressive central bank tightening.

CS expects 4–5 percent EPS (earnings per share) cuts to Nifty earnings estimates for the next couple of years. The key risks to India’s economy, and thus the markets, stem from crude oil prices and a worsening balance-of-payments situation, it said.

The brokerage highlighted that after 12 percent CAGR in 2006-12, Nifty EPS grew just 4 percent between 2012-19 and a 15 percent growth is expected from 2019-24.

"Just as the earlier slowdown was broad-based; the turn is too; most importantly, for financials. Weaker rupee, higher inflation may support earnings," it noted.

It further said that India’s P/E premium to the world is already elevated, and the global market outlook is not strong; though the P/E decline phase of markets is mostly over.

However, the brokerage said that it remains positive on India’s medium-term outlook and its relative attractiveness compared to other geographies despite inflation-related headwinds.

Once oil prices start to fall, foreign portfolio investors (FPI) outflows are likely to abate, it stated.

FPIs have remained net sellers in Indian equities for the past nine months since October 2021. Since then, it has sold equities worth $33.3 billion. DII flows are now dominant, and FII flows incrementally matter less for significant price action, added the brokerage.

The brokerage said that it continues to be overweight on Cement despite the negative impact of rupee depreciation primarily due to the expected turnaround in construction. It is also overweight on banks as higher inflation should support loan growth.

In this backdrop, CS advises investors to use this correction as a buying opportunity.