The Reserve Bank of India (RBI) on Thursday unexpectedly kept its benchmark rate at 6.5% while announcing its first bi-monthly policy for the new financial year 2023-24 (FY24), concluding a 3-day meeting. However, the RBI affirmed that it was prepared to act if necessary.

The annual retail inflation rate in India eased to 6.44% in February due to a decline in the price of some food items. However, it remained above the central bank's target band of 2%-6%.

In FY23, the RBI raised the interest rate by 250 basis points, causing the repo rate to increase to 6.5% from 4%. Earlier in its February 2023 meeting, the RBI raised its repo rate by the anticipated 25 basis points to 6.5%, marking the sixth consecutive rate hike.

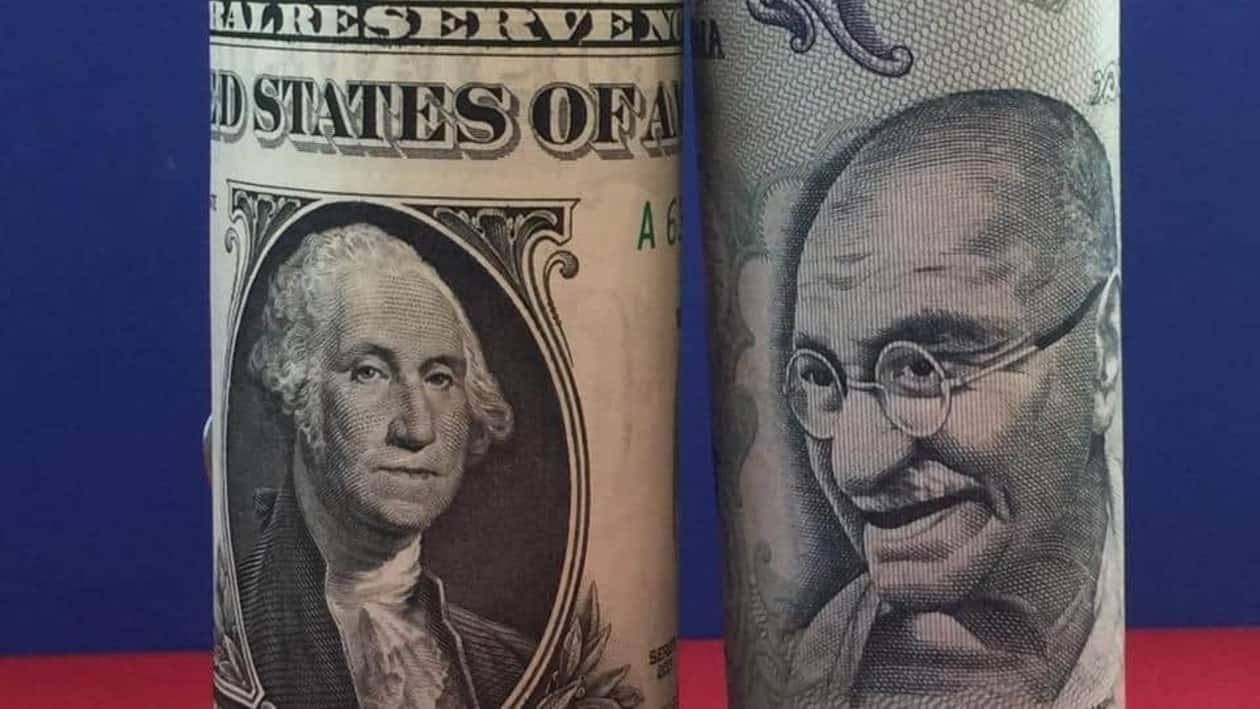

Following the RBI status quo on the repo rate, the Indian rupee rose 7 paise against the USdollar in Thursday's trade.

The Indian currency initially opened at 81.92 against the US dollar, and although it briefly weakened to 82.04, it later strengthened to 81.86 following the announcement by the RBI on rate hike pause.

On March 15, the Indian rupee almost reached an all-time low of 83.26, but it rebounded sharply after the RBI resumed selling foreign exchange reserves to support the local currency.

The rupee repeatedly reached new lows since the third quarter of 2022, and the RBI intervened to address an unbalanced current account and significant capital outflows.

The domestic currency depreciated significantly against the US dollar in FY23, hitting an all-time low in October. Overall, it lost 8.24% of its value against the greenback in the last fiscal year.

Out of 12 months in FY23, the Indian rupee recorded losses in nine, with September experiencing the largest monthly loss of 2.54% and January experiencing the smallest drop of 0.08%.

The rupee stood tremendous pressure through FY23 due to several factors, including the rise in crude oil prices, a strengthening dollar, and foreign portfolio investment (FPI) outflows.

For FY23, the Indian rupee saw its first monthly gain of 1.70% against the US dollar in November, backed by softening crude prices and a weakening US dollar.

Meanwhile, during Thursday's trade, the yield on the 10-year Treasury note decreased by 90 basis points to 7.18%, down from 7.27% the previous day. It is important to note that both bond yields and prices move in opposite directions.

Disclaimer: The views and recommendations made above are those of individual analysts or broking companies, and not of MintGenie.