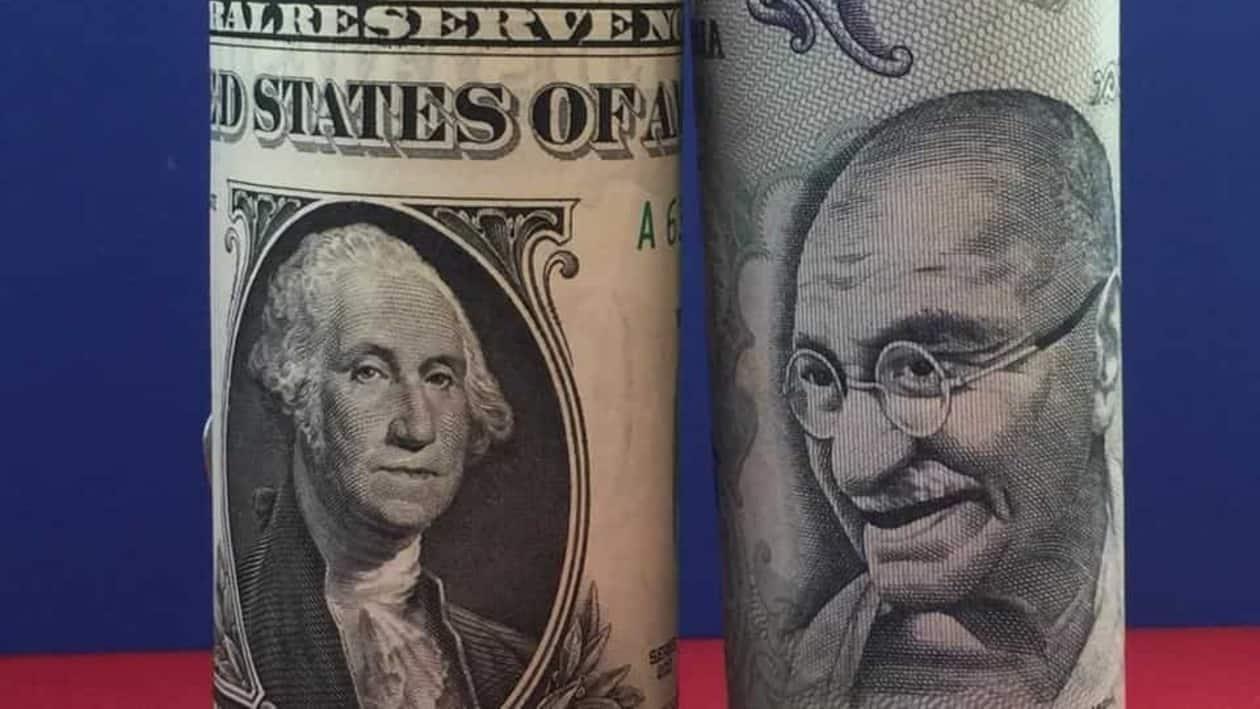

The Indian rupee finished 2022 on a low note by dropping 11.07 percent against the US dollar, falling from 74.46 per USD to its current position of 82.71 per USD. For the majority of last year, the rupee has been in the spotlight for breaking record lows.

The rupee has steadily depreciated since January, breaking through the psychological level of 80 per dollar for the first time on July 14th, and it maintained the decline to reach a record low of 83.26 per dollar on October 19th.

Out of 12 months in 2022, the Indian rupee saw losses in 11 of those months, with September suffering the largest monthly loss of 2.54 percent and January suffering the smallest drop of 0.08 percent.

The rupee posted its only monthly gain of 1.70 percent in November, owing to a sharp drop in crude oil prices, a strong return by the FPIs, and a fall in US annual inflation in October.

Besides the rupee, there are other major currencies, including the pound, euro, Australian dollar, and Canadian dollar, that have corrected by 5 to 11 percent against the U.S. dollar in 2022. Since the Brexit referendum in 2016, the British pound had its worst year in 2022.

For the first time in nearly 20 years, the euro reached parity (1.0000) against the US dollar in July. The last time it happened was in November 2002, when the euro was worth $0. 99.

The rupee's decline began in February, when the Russia-Ukraine conflict drove commodity prices to record highs, placing pressure on the rupee.

Adding to the challenges, the US Fed began raising interest rates from March.

Following the relentless rate hike from the US Fed, the dollar index gained 19.56 percent to hit a 20-year high of 114.77 on September 28 though it lost some ground and corrected by 9.80 percent. Overall in 2022, the dollar gained 7.87 percent.

During the second rate hike, the US Fed announced the shift to quantitative tightening from quantitative easing, which in turn boosted the dollar as it restricted the free flow of dollars.

On the other hand, the strong dollar made India's trade deficit larger and increased the pressure on the rupee by triggering a steady rise in dollar outflows.

In July, India's trade deficit reached a record high of $30 billion. The trade deficit increased to USD 149.47 billion in the first six months of the fiscal year, up from USD 76.25 billion in April–September 2021–22, according to media reports.

The widening trade deficit pushed India's current account deficit to a high of USD 36.4 billion, or 4.4 percent of GDP, in the second quarter of the current fiscal, as against 2.2 percent in April-June and 1.3 percent in July-September 2021.

Meanwhile, continuous rate hikes from the US Fed have pushed US Treasury bond yields higher, attracting investors seeking higher yields than they can find elsewhere in the world.

In 2022, foreign portfolio investors (FPIs) sold Indian equities worth ₹1.21 lakh crore, which is the highest-ever yearly outflow. Before this, the highest recorded outflow was in 2008, amid the global financial crisis, when foreign investors sold Indian equities worth ₹53,000 crore.

The Reserve Bank of India (RBI) has taken every possible step to defend the Rupee in 2022; as a result, the central bank used its foreign exchange reserves at a quicker pace than during the taper-tantrum period in 2013, as per reports.

In July, the RBI introduced a rupee settlement system for international trade to save the foreign exchange reserves and arrest the plunging domestic currency. The RBI also introduced various other types of measures, including an increase in overseas borrowing limits for companies and the removal of cap on the interest rate that lenders can offer on foreign deposits by NRIs.

Adding to that, the RBI also raised the External Commercial Borrowing (ECB) limit under the automatic route from USD 750 million or its equivalent per financial year to USD 1.5 billion and eased the norms for FPI investments in the debt market.

Going forward, Motilal Oswal Financial Services (MOFSL) expects that volatility for the rupee could continue to remain elevated and with central banks at this point of time continuing to remain hawkish, it is likely to be supportive for the dollar across the board, PTI reported.

"We expect that the USD-INR (Spot) could trade with a positive bias and in the next quarter could quote in the range of 81.50 and 84.50," said Navneet Damani, Senior Vice President, Currency and Commodity, MOFSL.

Disclaimer: The views and recommendations made above are those of individual analysts or broking companies, and not of MintGenie.