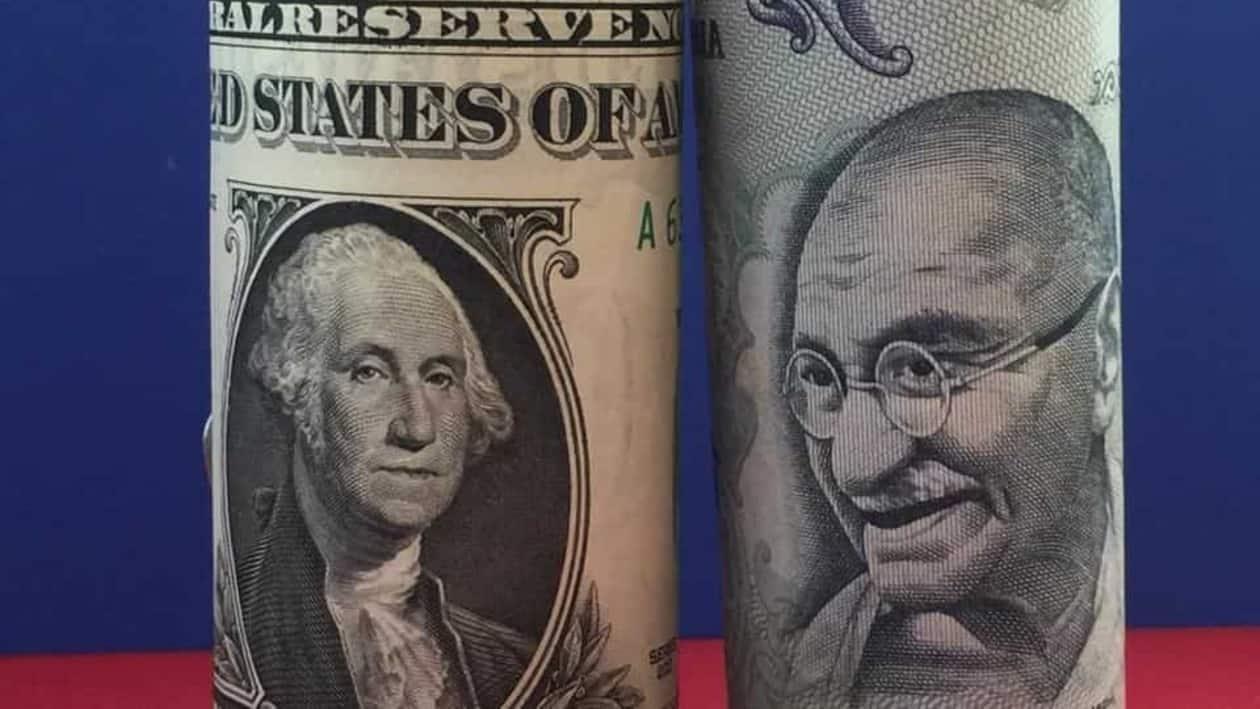

(Reuters) - The Indian rupee advanced versus the dollar on Thursday on expectations that the U.S. Federal Reserve could pivot to a less hawkish monetary stance after next week's meeting.

The rupee rose to 82.4900 per U.S. dollar from 82.7250 in the previous session. The local unit opened at 82.15, before slipping to almost 82.50 by close on dollar demand related to the daily fixing and from importers.

The monthly USD/INR October futures expired Thursday, while the pullback in Treasury yields lifted rupee's forward premium.

Treasury yields are well off recent highs on speculation that the Fed could opt for smaller rate increases after the November meeting.

Softer U.S. economic data has prompted traders to dial back bets of a 75 bps rate increase at the Fed meeting in December.

The central banks of two developed nations this month have delivered a smaller rate hike than was expected, prompting traders to raise the odds for a Fed pivot.

On Wednesday, the Bank of Canada increased rates by 50 bps against 75 bps expected. Earlier this month, the Reserve Bank of Australia delivered a 25 bps increase versus an estimated 50 bps.

"The market will no doubt be awash with speculation about whether this (the BOC move) represents part of the “pivot” story," ING Bank said.

"Next move - the Fed. They can either quash any such thoughts or, as it seems to have been doing recently, kindle them with some encouraging noises even as it hikes rates by 75 bps next week."

The dollar index has dropped to around 110, down about 1.7% this week. The 10-year Treasury yield is down about 30 basis points from highs.