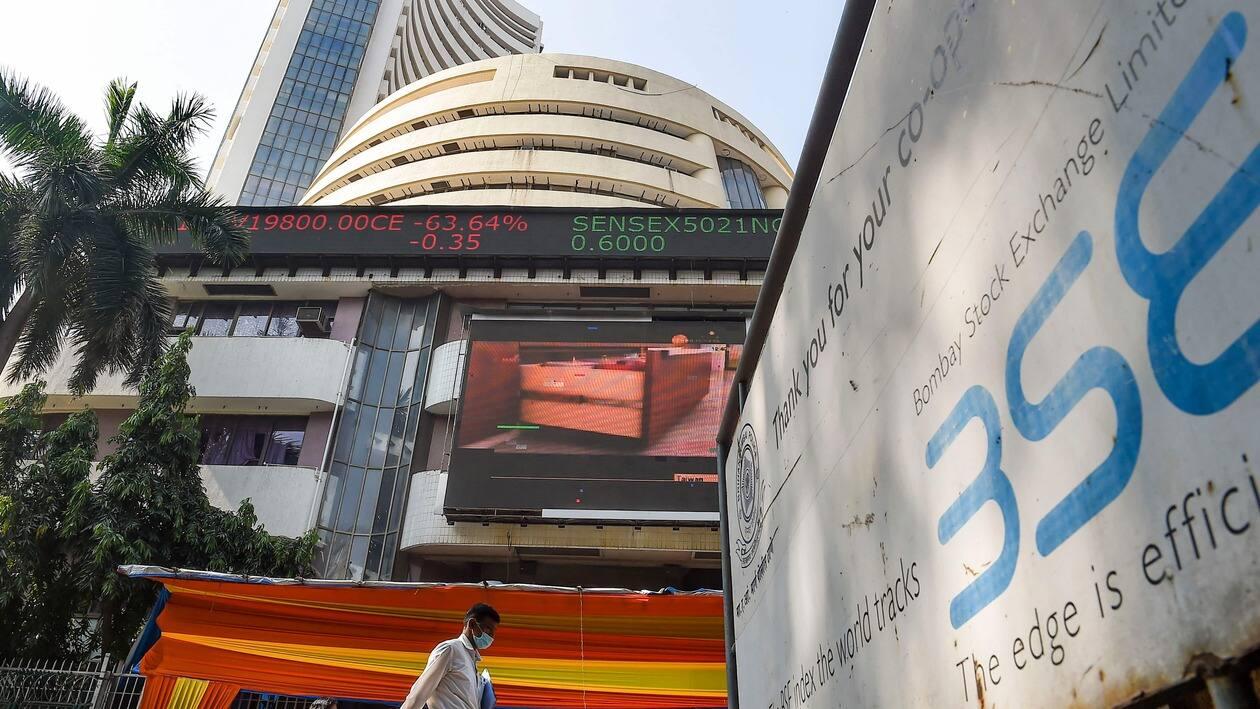

Domestic market benchmarks the Sensex and the Nifty ended lower on December 7 amid mixed global cues after the Reserve Bank of India (RBI) raised the policy rate by 35 bps to 6.25 percent but did not give any hint on any pause on the rate hikes in the near future which might have disappointed the market.

Weak global cues also weighed on sentiment as top executives of major global financial firms raised alarm on the economy.

"Top executives at Goldman Sachs, J.P. Morgan and Bank of America all sounded downbeat in remarks on Tuesday about the economic outlook, hurting risk appetite globally and triggering fresh recession signals from bond markets," reported Reuters.

Sensex opened 11 points lower at 62,615.52 and rose 134 points to the intraday high of 62,759.97 in morning trade. However, it soon erased all gains and fell 310 points to hit the intraday low of 62,316.65 after the RBI raised the repo rate by 35 bps.

The index finally closed 216 points, or 0.34 percent, lower at 62,410.68 while the Nifty50 settled at 18,560.50, down 82 points, or 0.44 percent.

Mid and smallcaps also suffered losses. The BSE Midcap index fell 0.41 percent while the Smallcap index declined 0.44 percent.

Shares of Asian Paints, Hindustan Unilever and Larsen & Toubro ended as the top gainers while those of NTPC, Bajaj Finserv and IndusInd Bank ended as the top laggards in the Sensex index.

Mid and smallcaps also suffered losses. The BSE Midcap index fell 0.41 percent while the Smallcap index declined 0.44 percent.

Shares of Asian Paints, Hindustan Unilever and Larsen & Toubro ended as the top gainers while those of NTPC, Bajaj Finserv and IndusInd Bank ended as the top laggards.

Most sectoral indices ended in the red, with Nifty Realty falling 1.19 percent and Nifty Auto down 0.80 percent. Nifty Bank settled 0.09 percent lower. Nifty FMCG rose 0.96 percent and Nifty PSU Bank rose 0.26 percent, bucking the trend.

"Markets extended losses for the fourth straight session as investors dumped realty and automobile stocks on worries that higher EMI outgo post the RBI's repo rate hike could dent demand going ahead. Although the rate hike came on expected lines, the RBI showing no signs of letting off in its fight against inflation raised concerns that more hikes could be in the offing going ahead which would hurt growth," said Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities.

"As the economy deals with the global headwinds, the RBI has become more realistic, lowering the FY23 GDP growth forecast from 7 percent to 6.8 percent. The focus remains on fighting inflation which will lead to an increase in interest rates in future. Along with a global slowdown, corporate earnings forecast for the second half of FY23 and FY24 can downgrade. The market is currently trading at premium valuations, a slowing earnings growth will impact market sentiment," said Vinod Nair, Head of Research at Geojit Financial.

Crude oil prices fell further amid concerns over demand owing to a looming recession. Brent Crude fell more than a percent near $78 per dollar.

The rupee rose 14 paise to close at 82.48 per dollar.

Technical view by experts

Chouhan pointed out on intraday charts, the Nifty is still holding a lower top formation and also formed a small bearish candle on daily charts which is broadly negative.

"For traders, as long as the index is trading below 18,650 the correction wave is likely to continue. Below the same, the index could slip to 18,500-18,425. On the other hand, above 18,650, the index could move up to 18,750-18,800," said Chouhan.

Rupak De, Senior Technical Analyst at LKP Securities said the index slipped below its recent consolidation on the hourly chart, suggesting a waning bullishness.

"The momentum oscillator is in a bearish crossover. The trend is likely to remain negative going forward, support on the lower end is pegged at 18,500-18,350. On the higher end, resistance is visible at 18,670-18,750," said De.

Key market data

Disclaimer: The views and recommendations given in this article are those of individual analysts. These do not represent the views of MintGenie.