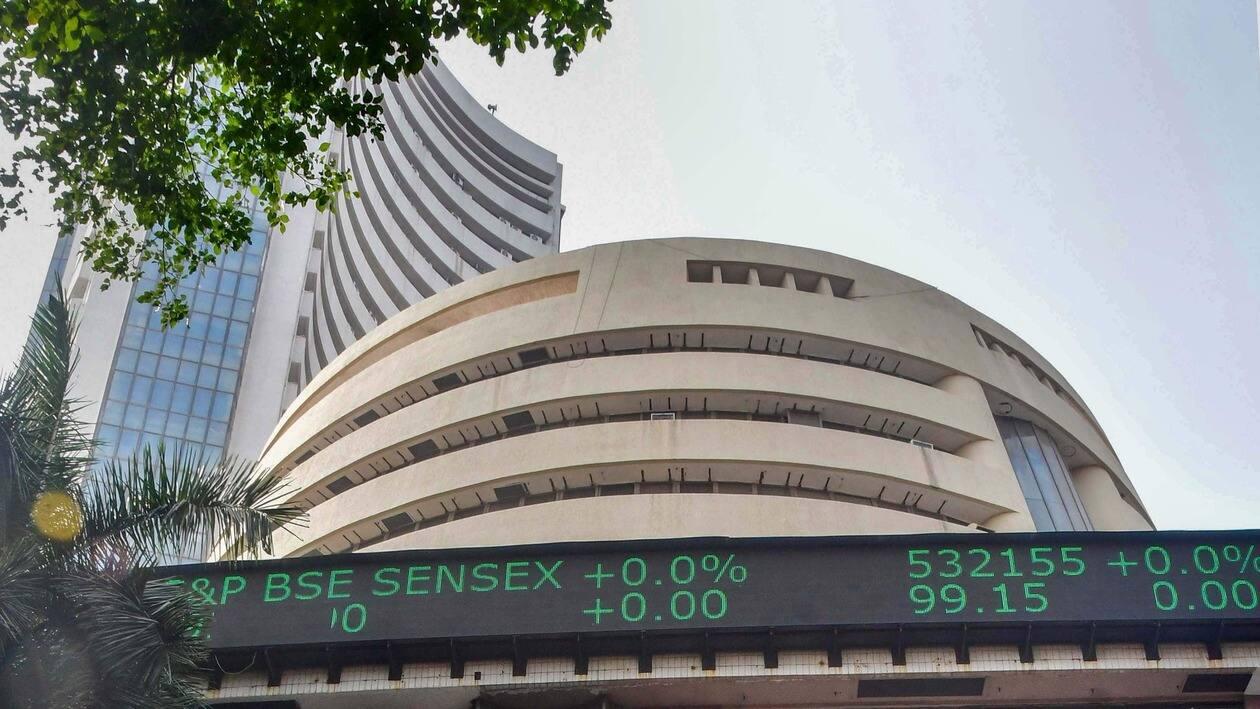

Domestic equity benchmarks the Sensex and the Nifty ended in the red, extending losses into the sixth consecutive session on lingering concerns over rate hikes, economic slowdown and geopolitical tensions.

In the last six sessions of trade, Sensex and Nifty have fallen 3 percent each. The overall market capitalisation of BSE-listed firms dropped to ₹260 lakh crore from ₹268 lakh crore on February 16, making investors poorer by ₹8 lakh crore in six sessions.

Domestic equities fell even as major US and European markets witnessed some gains. Of late, concerns over a longer spell of rate hikes by central banks and its impact on their economies have kept markets volatile.

Sensex closed 142 points, or 0.24 percent, lower at 59,463.93. Nifty50 closed the day at 17,465.80, down 45 points, or 0.26 percent.

Mid and smallcaps also ended lower; the BSE Midcap index slipped 0.17 percent while the Smallcap index fell 0.15 percent.

As many as 224 stocks, including Adani Green Energy, Adani Transmission, Adani Total Gas, Biocon, Emami, Godrej Properties and Ipca Laboratories, hit their 52-week lows in intraday trade on BSE.

Crude oil prices rose as the prospect of lower exports from Russia offset rising inventories in the United States and concerns over global economic activity, reported Reuters.

Brent Crude traded over a percent higher near the $83 per barrel mark. The rupee ended flat at 82.75 per dollar even though the greenback looked set for a fourth consecutively week gain.

Top Nifty gainers: Shares of ONGC, Adani Ports and Asian Paints ended as the top gainers in the Nifty index.

Top Nifty losers: Shares of Adani Enterprises, Hindalco and Mahindra and Mahindra ended as the top laggards in the Nifty50 pack.

As many as 26 stocks ended in the green while 24 were in the red in the Nifty50 pack.

Sectoral indices

Metal and mining stocks suffered strong losses making their sectoral index end with deep cuts. The Nifty Metal index closed with a loss of 3 percent with 13 components in the red and two - Hindustan Zinc and Ratnamani Metals - in the green.

Shares of Adani Enterprises, Hindalco and National Aluminium Company ended as the top losers in the Nifty Metal index, falling up to 5 percent.

Nifty Oil & Gas index rose over half a percent while the Nifty Consumer Durables, Healthcare and Pharma indices ended with mild gains.

Experts' views on markets

"The domestic market is broadly demonstrating a lack of confidence, registering its sixth consecutive day of losses despite global markets turning green. Continued selling in the domestic market by FIIs is acting as an overhang in sustaining the early gains. Crude oil prices rallied as the prospect of lower Russian exports outweighed rising US inventory," said Vinod Nair, Head of Research at Geojit Financial Services.

Amol Athawale, Deputy Vice President - Technical Research at Kotak Securities pointed out that the downward spiral continued amid a sharp bout of intra-day volatility as uncertainty surrounding the weak global economic scenario coupled with the probability of the US Fed maintaining a hawkish stance going ahead weighed on the sentiment.

"The markets may continue to witness intermittent bearish spells as investors are likely to cut their long positions owing to multiple negative factors," said Athawale.

Technical views on markets

Rupak De, Senior Technical Analyst at LKP Securities underscored that the Nifty fell back into the falling channel, heightening the chances of further downsides.

"The 50-day moving average and 14-day moving average are in a bearish crossover. Also, the current value is sitting well below the critical near-term moving averages, with the momentum oscillator RSI (14) slipping below the reading of 50. The current set-up is likely to keep the Nifty under pressure, with a potential downside towards 17,150–17,200 over the short term. On the higher end, crucial resistance is placed at 17,800," said De.

"The Nifty has formed a long bearish candle on weekly charts which indicates further weakness from the current levels. However, with the market in oversold territory, we could see a quick pullback rally if the index trades above 17,500," said Athawale.

"Above 17,500, the pullback formation is likely to continue till 17,600-17,750. On the flip side, as long as the index is trading below 17,500, the weak sentiment will continue. Below which the index could retest the level of the 200-day simple moving average or 17,400,” said Athawale.

Key market data

Disclaimer: The views and recommendations given in this article are those of individual analysts. These do not represent the views of MintGenie.