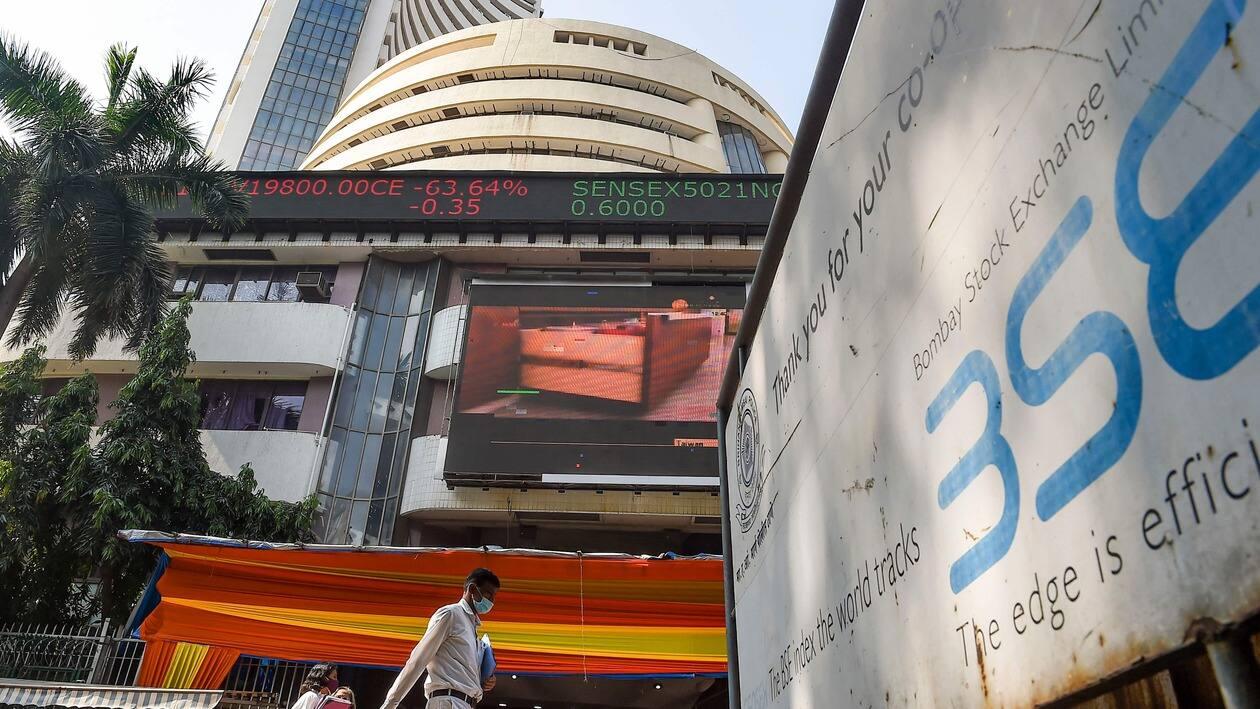

The Indian equity markets closed higher in Friday's trading session, aided by strong buying in IT and banking stocks. The Nifty opened with a 308-point gap up and reached an intraday high of 17,348.55 and finished the day with a gain of 171.35 points, or 1.01% higher at 17,185. Similarly, the Sensex started the day sharply higher at 58,162.74 points and surged to an intra-day high of 58,322.47 points, the index finally closed with a gain of 684.64 points, or 1.19%, at 57,919.97.

The Indian rupee ended the week at 82.34, up 0.58% against the US dollar, snapping a four-week losing streak thanks to strong support from the Reserve Bank of India.

American brokerage firm BofA Securities expects the Indian rupee to hit 83 by March 2023. The brokerage said the continuous fall in the forex reserves and widening balance of payment deficit will add pressure to the rupee. The brokerage also cut the Nifty year-end target by 1,000 points, to 17,500 from 18,500 earlier.

In August, the brokerage raised its Nifty forecast in the range of 18,500-19,500 points, citing strong FPI and domestic inflows.

For the second month in a row, foreign portfolio investors kept up their selling frenzy in October. FPIs have sold equities to the tune of ₹6,947 crore worth of stocks till October 14th. On Friday, FPIs net sold ₹1,011.2 crore, Trendlyne data showed.

After rallying 15% in the first week of October, crude oil prices declined 4% this week as a result of growing recession worries. On Wednesday, US President Joe Biden acknowledged the possibility of a recession. Prior to that, JPMorgan Chase & Chief Executive Officer Jamie Dimon said "serious" headwinds are likely to push the US and global economies into a recession by the middle of next year.

Earlier this week, OPEC, the US energy department and the international agency all slashed their oil demand forecasts in their monthly reports. On the other hand, US crude inventories surged by 9.9 million barrels last week, way more than the market expectation of a 1.8 million rise, according to the Trading Economics.

In the second week of October, only one stock delivered a double-digit return and 13 stocks jumped between 5 and 9%.

Rajesh Exports, was the top gainer among BSE 500 stocks this week. The stock has climbed from ₹606.60 to ₹694.20, generating a return of over 14.44%.

The stock ended green in Friday's trade with a gain of ₹21.50, or 3.20%, at ₹694.20. During intraday, the stock moved to a near seven-month high. In the last month, the stock has returned 22.43%.

Brightcom Group emerged as the second top gainer in the BSE500 Index. The stock rose 9.1 this week, moving from ₹36.70 to ₹40.05. During Friday's intraday, the stock recorded a volume of 41.9 million, a 1.51x surge over its average weekly volume of 27.8 million.

| Scrip Name | % Weekly Returns |

| Rajesh Exports | 14.4 |

| Brightcom Group | 9.1 |

| Castrol India | 8.7 |

| Angel One | 8.0 |

| IDFC Ltd | 8.0 |

| Rites | 6.3 |

| Federal Bank | 6.1 |

| La Opala RG Ltd | 6.1 |

| Axis Bank | 5.9 |

| ZF Commercial Vehicle Control Systems India | 5.8 |

| Tata Teleservices (Maharashtra) | 5.6 |

| KRBL | 5.5 |

| Sun Pharma Advanced Research Company | 5.2 |

| Ratnamani Metals & Tubes Ltd. | 5.0 |

Angel One shares delivered 8% returns this week. The stock started moving higher after the company reported a 77.4% jump in its client base to 11.57 million in September 2022 as against 6.52 million in the same month of the previous year. On a sequential basis, the company's client base rose by 3.4% month on month (MoM) from 11.18 million clients in August 2022.

The average daily turnover of Angel jumped to ₹13,73,800 crore in September. On Friday, the company reported a 59% jump in its net profit to ₹213.6 in the September ending quarter.

Angel One is the largest listed retail stock broking house in India in terms of active clients on the NSE.

Other stocks, including Castrol India IDFC, Rites, Federal Bank, Axis Bank, Tata Teleservices Maharashtra, KRBL, and Sun Pharma advanced research, and also witnessed a return of between 5–9% this week.

Disclaimer: The views and recommendations made above are those of individual analysts or broking companies, and not of MintGenie.