Due to Metro Brands Ltd's best-in-class business strategy, growth prospects, execution skills, lean balance sheet, and quality management, brokerage firm Nuvama Wealth and Investment Ltd recommends the stock for long term.

The brokerage house has given a 'buy' rating to the stock with a target price of ₹909, indicating a potential upside of 18% from the current market price of ₹770.

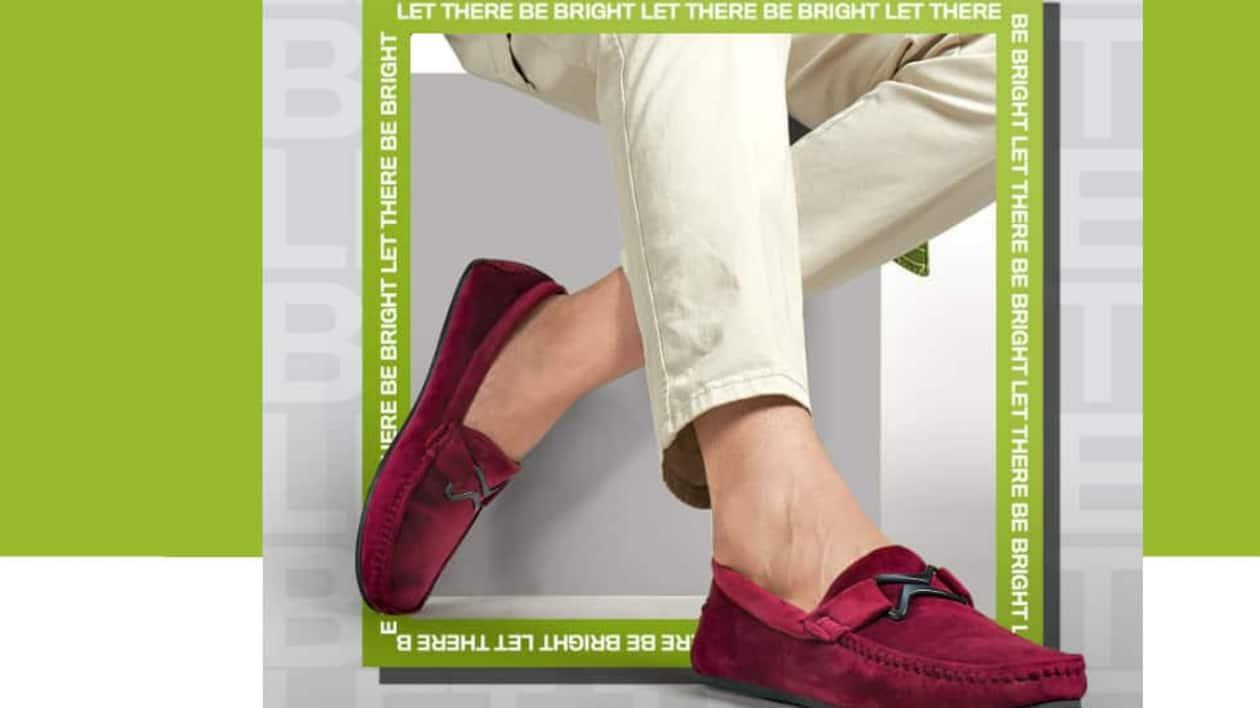

Footwear Segments - Clear beneficiary of the premiumisation trend

The brokerage report claims that over the course of its 65-year operation, the company has developed a number of powerful brands that appeal to all occasions across age groups and market segments, leading to high levels of customer loyalty. The business has positioned itself as a non-mass segment brand and has kept its relevance as an all-season brand.

The company operates nationwide stores for its own Metro, Mochi, Walkaway, FILA, and Proline and third-party brands, Crocs and FitFlops.

"With India’s per capita income on the rise, consumers are veering towards premium brands. We believe the company will be the key beneficiary of this trend as it has positioned itself in the mid and premium categories where the premiumisation theme is playing out. Its average selling price is the highest among its peers," said the brokerage.

Store Expansion and recent acquisition - A topline growth driver

The company had 624 stores as of March 22 and it plans to open 260 more across different formats by FY25. In December 2021, it raised ₹225 crore through an initial public offering to fund for this growth. In 9MFY23, it launched 96 stores, and it plans to add 80 stores each year. It acquired Cravatex, which runs the FILA and Proline labels in India, to enter the sports and athleisure category, a brand-new market that would diversify the company's offerings.

"We expect 29% revenue compound annual growth rate (CAGR) over FY22–25E led by around 10% same-store sales growth (SSSG) and new store additions of about 13%," said the brokerage.

Asset light model with industry-leading margin

Although the business has no in-house manufacturing, it outsources all of its production. It has built relationships with more than 250 vendors over three generations, giving it the freedom to work with a specialist vendor in a specific footwear sector, which boosts productivity and margins. Most third-party arrangements specify that it can return unused inventory and only pays for the goods when they are sold.

"This asset-light model and higher margins results in industry-leading return ratios. We expect 420 basis points expansion in operating margin to nearly 35% led by premiumisation, addition of higher margin footwear segments and cost efficiencies," said the brokerage.

Valuation and view

Although the company's revenue is almost half that of Bata and Relaxo Footwear, it has been able to maintain comparable operating metrics, exhibiting the strength of its business strategy.

The brokerage thinks that the company will continue to produce strong operating metrics as a result of its aggressive store expansion strategy over the next three years, the addition of newer formats and channels, a higher percentage of premium products in its line-up, and an expanding collection of accessories and related categories.

"In addition, acquisition of FILA/Proline brands and partnership with Fitflops provides ample growth opportunities and significant upside to current assumptions if the company executes well to scale up these brands.

The company deserves a premium multiple, given its best-in-class store economics (high double-digit store-level return on capital employed (RoCE) with a payback period of less than two years), robust margin profile, high double-digit return ratios, and huge expansion plans providing ample scope for growth," added the brokerage.