Even as the Reserve Bank of India recognises prevailing uncertainty on growth and the risk of inflation led by the Ukraine war, it probably has done what it could have- preferring growth over taming inflation at this juncture.

The primary role of RBI MPC is to keep retail inflation below 6 percent. In January and February, India's retail inflation breached the RBI's tolerance level of 6 percent and the chatter started to gain momentum that the central bank will have to bite the bullet and follow the path of aggressive policy normalisation, like the way US Fed has hinted.

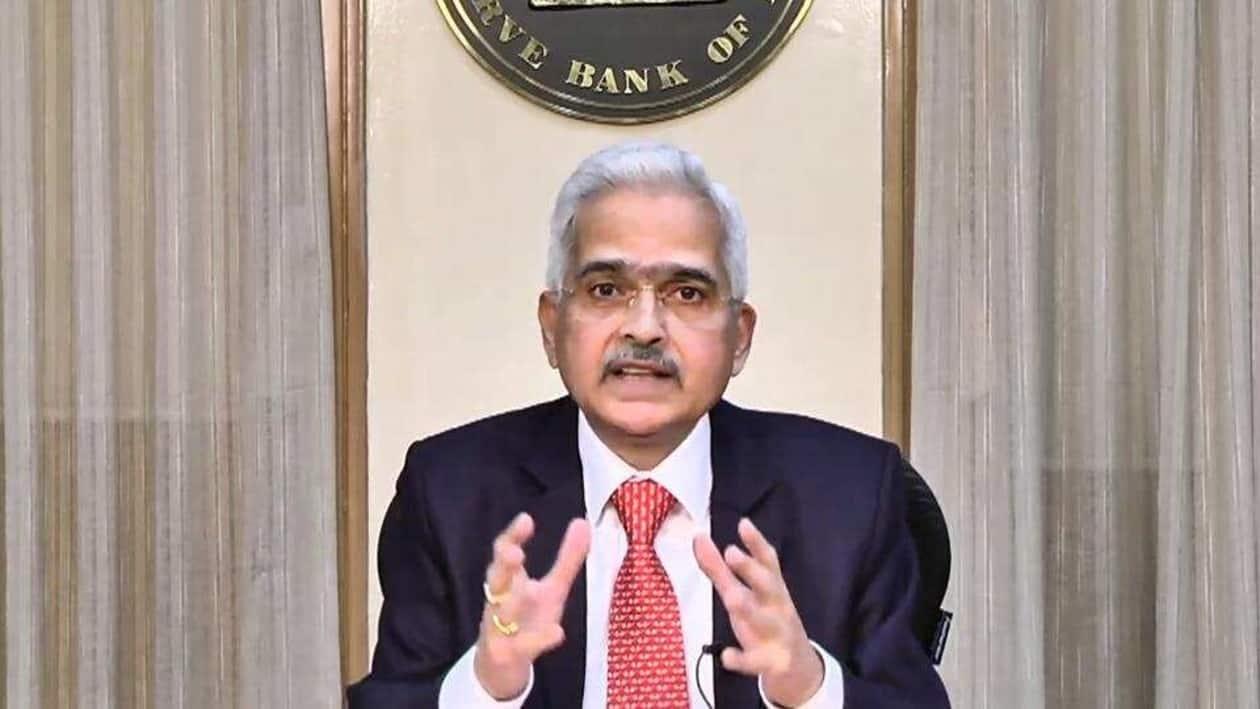

"The conflict in Europe now poses a new and overwhelming challenge, complicating an already uncertain global outlook. As the daunting headwinds of the geopolitical situation challenge us, the RBI is braced up and prepared to defend the Indian economy with all instruments at its command," the RBi governor Shaktikanta Das said in his speech after the RBI MPC meet on April 8.

As per Sashi Sivramkrishna, Senior Adjunct Professor of Economics at NMIMS, Bangalore, maintaining the status quo on rates was the best option for RBI at this juncture.

"Given the tradeoffs between growth forecast trimmed down to 7.2 percent, inflation expected at 6.3 percent this quarter and pressure on the current account in the balance of payments, the best and possibly the only option available to the RBI was to maintain status quo by keeping the repo rate at 4 percent. Any change in monetary policy would only have added to the volatility and uncertainty facing economies across the world," said Sivramkrishna.

Let's take a look at the key highlights of the first MPC meet of FY23.

Growth forecast lowered

RBI has projected real GDP growth for the financial year 2022-23 at 7.2 percent with Q1 growth at 16.2 percent, Q2 at 6.2 percent, Q3 at 4.1 percent, and Q4 at 4 percent, assuming crude oil (Indian basket) at US$ 100 per barrel during 2022-23.

RBI underscored that the Ukraine war is a matter of serious concern even as the country's direct trade exposure to Russia and Ukraine is limited.

The beginning of policy normalisation in developed economies renewed Covid-19 infections and shortage of key ingredients such as semiconductors are the other factors that may hit the growth.

"The war could potentially impede the economic recovery through elevated commodity prices and global spillover channels. Further, financial market volatility induced by monetary policy normalisation in advanced economies, renewed COVID-19 infections in some major countries with augmented supply-side disruptions and protracted shortages of critical inputs, such as semiconductors and chips, pose downside risks to the outlook," RBI governor said.

Inflation forecast raised

RBI expects inflation at 5.7 percent in FY23, with Q1 at 6.3 percent, Q2 at 5.8 percent, Q3 at 5.4 percent, and Q4 at 5.1 percent.

On March 22, governor Das, speaking at the Confederation of Indian Industry National Council Meeting had said that the current spike in inflation was transitory and it might moderate in months to come.

"The February 2022 meeting of the MPC had projected a moderating path for inflation during 2022-23. Heightened geopolitical tensions since end-February have, however, upended the earlier narrative and considerably clouded the inflation outlook for the year," Das said.

Growth remains in focus

RBI governor highlighted the daunting headwinds of the geopolitical situation are challenging but the RBI is braced up and prepared to defend the Indian economy with all instruments at its command.

"As we have demonstrated over the last two years, we are not hostage to any rulebook and no action is off the table when the need of the hour is to safeguard the economy. Our goals of price stability, sustained growth and financial stability are mutually reinforcing and we continue to be guided by this approach," said Das.

Gradual path of policy normalisation

RBI governor said that the path of policy normalisation will not be steep but gradual and non-disruptive to ensure the stability of the financial market.

"The RBI will engage in a gradual and calibrated withdrawal of this liquidity over a multi-year time frame in a non-disruptive manner beginning this year. The objective is to restore the size of the liquidity surplus in the system to a level consistent with the prevailing stance of monetary policy," said Das.

"I would like to reiterate our commitment to ensure the availability of adequate liquidity to meet the productive requirements of the economy. We also remain focussed on completion of the borrowing programme of the government and towards this end, the RBI will deploy various instruments as warranted," he added.