The unprecedented heat wave in India in the month of March and April of 2022 has left everyone gasping for breath. With temperatures in India already rising over 40 degrees, conditions are expected to worsen in the coming days.

Rising summer temperatures mean brisk business for consumer durable firms; Will margins spoil the party?

When compared to the previous year, the AC business rose by 27% in volume terms and 38% in value terms in March 2022, but the near-term future is dependent on commodity price movements and price hike absorption.

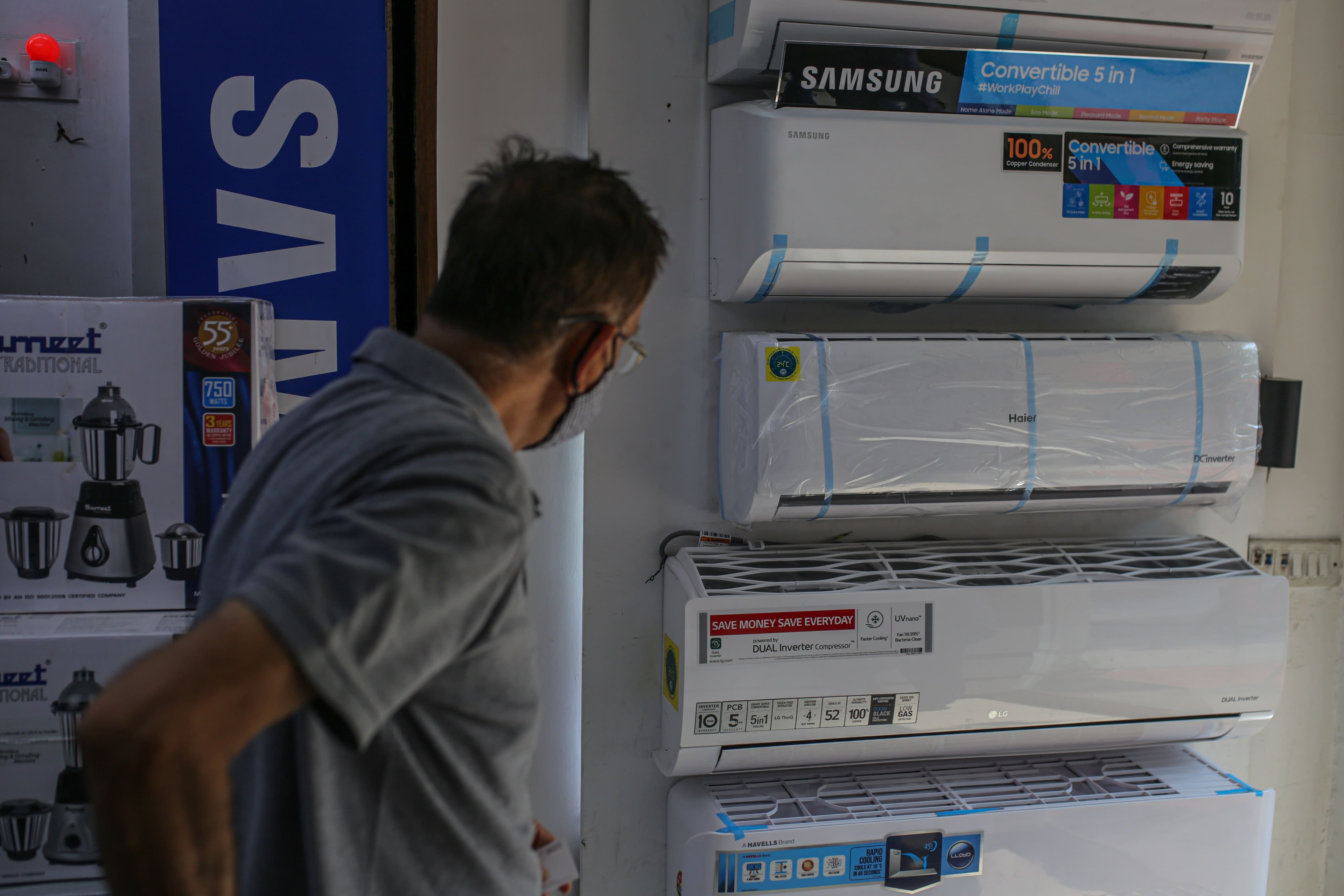

Consumer durable companies, naturally, are looking at a season of brisk sales for airconditioners, coolers and refrigerators. They are also expecting a healthy summer season this year following two summers that were nearly washed out due to covid-related restrictions in 2020 and 2021.

Appliance makers are hoping for a rebound this summer, with a big portion of the population now vaccinated and a moderate third wave.

Current demand trend

Room air conditioners (RAC) have been in good demand since the onset of summer. Volumes started to pick up in March and have been continuing in April too. The current pick-up is driven by rising temperatures and pent-up demand from last year, mainly in the construction sector, says B&K Securities in a research report.

In March 2022, the AC business grew by 27% in volume terms and 38% in value terms as compared to last year on the back of early heat waves in some parts of the country.

Further, refrigerators also saw robust demand in 2022, but washing machines and dishwashers have not picked up, mainly due to the off-season. Consumers have shifted their budgets towards buying cooling products, the report added.

Other electronic items, such as mixer grinders and OTG, have now become more common in comparison to the Covid-period. when demand was exceptionally high due to an increase in home-food consumption.

The report says that cashback offers and zero-cost EMIs have led to sharp growth in financing decisions. The increase in the variety of financing options and offers is one of the reasons for the good demand for electronic products.

Demand remains strong despite price hikes

Window air conditioner prices have risen by 20–25% in the last year, while split air conditioner prices have risen by 10–15%. Brands have taken further price hikes of 2-3% from April onwards.

The brokerage house believes that the impact of the price increase on demand is unascertainable as of now, mainly due to two reasons: (a) showrooms used to sell ACs in March at old prices to clear inventory and have started selling at higher prices from April onwards, and (b) frequent heatwaves and soaring temperatures are playing a bigger role in buying decisions than price hikes.

The price gap between inverter and non-inverter ACs has been meaningfully reduced, it added.

Market share and Brand specifics

Voltas is the market leader and most preferred brand in both window and split air conditioners, owing to brand loyalty resulting from higher product quality and positive customer experiences, which lead to repeat purchases.

Lloyd has been clocking good volumes as compared to last year and has adopted an aggressive strategy compared to the rest of its peers. It also enjoys good customer loyalty and referrals due to its superior product quality. It is the most aggressive brand currently.

Blue Star, despite being perceived as a commercial brand, is believed to have been growing its market share in the room air conditioner category. People have started accepting Blue Star as a consumer brand as the perception is gradually changing. However, the absorption of the price hike remains a challenge for Blue Star. The price of Window AC from Blue Star is higher as compared to other brands.

B & K Securities is bullish on Crompton Greaves Consumer Electricals/Bajaj Electricals and KEI Industries. It also believes that a summer season with above-normal temperatures is likely to bode well for cooling products, but the near-term outlook depends on the movement of commodity prices and the absorption of price hikes, it added.

Margins remain under pressure

Meanwhile, HDFC Securities expects the consumer durables sector to deliver revenue growth and a three-year CAGR of 13/11% YoY in Q4FY22 (vs. 42/9% in Q4FY21 and 7/11% in Q3FY22).

Demand for non-seasonal products is also sustaining a healthy trend, despite inflationary pressure. Most companies are at a high revenue base; hence, reported growth will be slow, but three-year revenue CAGR is expected to be 11% for our coverage, the report added.

Further, it expects margin pressure will continue; aggregate EBITDA YoY/three-year CAGR may stand at 2/19%. Companies will continue to witness margin pressures due to the restoration of overhead costs along with elevated commodity costs.

According to the report, RM inflation will have an impact on operating margins, but it also provides an opportunity for small/regional players to gain market share.

HDFC Securities has given a buy rating on Crompton Consumer and Orient Electric and ADD ratings on Havells, Voltas, TTK Prestige, V-Guard, and Symphony.

Disclaimer: The views and recommendations made above are those of individual analysts or broking companies, and not of MintGenie.