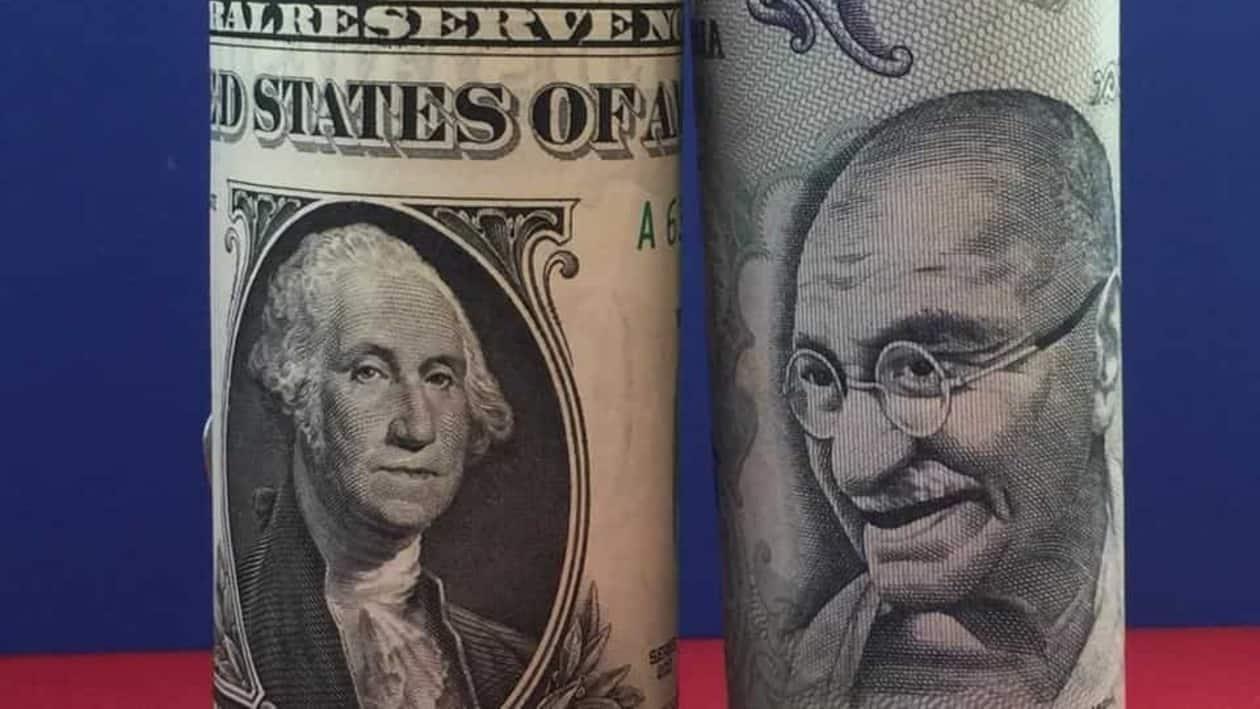

(PTI) The rupee appreciated by 17 paise to close at 81.11 (provisional) against the US dollar on Tuesday, on positive domestic macroeconomic data and weak American currency.

Forex traders said a firm trend in domestic equities, sustained foreign fund inflows and easing crude oil prices also supported the local unit.

At the interbank foreign exchange market, the local unit opened at 81.18 and touched an intra-day high of 81.04 and a low of 81.45 against the greenback.

The local unit finally settled at 81.11, registering a rise of 17 paise over its previous close.

On Monday, the rupee depreciated by 50 paise to close at 81.28 against the US currency.

"Rupee opened on a flat note and started to appreciate in the latter half. Momentum in the dollar turned negative after one of the Fed members hinted towards a slower rate hike process," said Gaurang Somaiya, Forex & Bullion Analyst, Motilal Oswal Financial Services.

On the domestic macroeconomic front, indicating easing of the price situation, retail inflation moderated to 6.7 per cent in October while the wholesale price index-based inflation fell to a 19-month low mainly on account of subdued rates of food items.

"Today focus will be on the German economic sentiment and weaker-than-expected data keep the crosses weighed down," Somaiya said, adding, "we expect the USDINR (spot) to trade sideways and quote in the range of 80.80 and 81.60."

Meanwhile, the dollar index, which gauges the greenback's strength against a basket of six currencies, slipped 0.38 per cent to 106.25.

Global oil benchmark Brent crude futures fell 1.47 per cent to USD 91.77 per barrel.

On the domestic equity market front, the 30-share BSE Sensex advanced 248.84 points or 0.40 per cent to end at 61,872.99, while the broader NSE Nifty gained 74.25 points or 0.41 per cent to 18,403.40.

Foreign Institutional Investors (FIIs) were net buyers in the capital markets on Monday as they purchased shares worth ₹1,089.41 crore, according to exchange data.