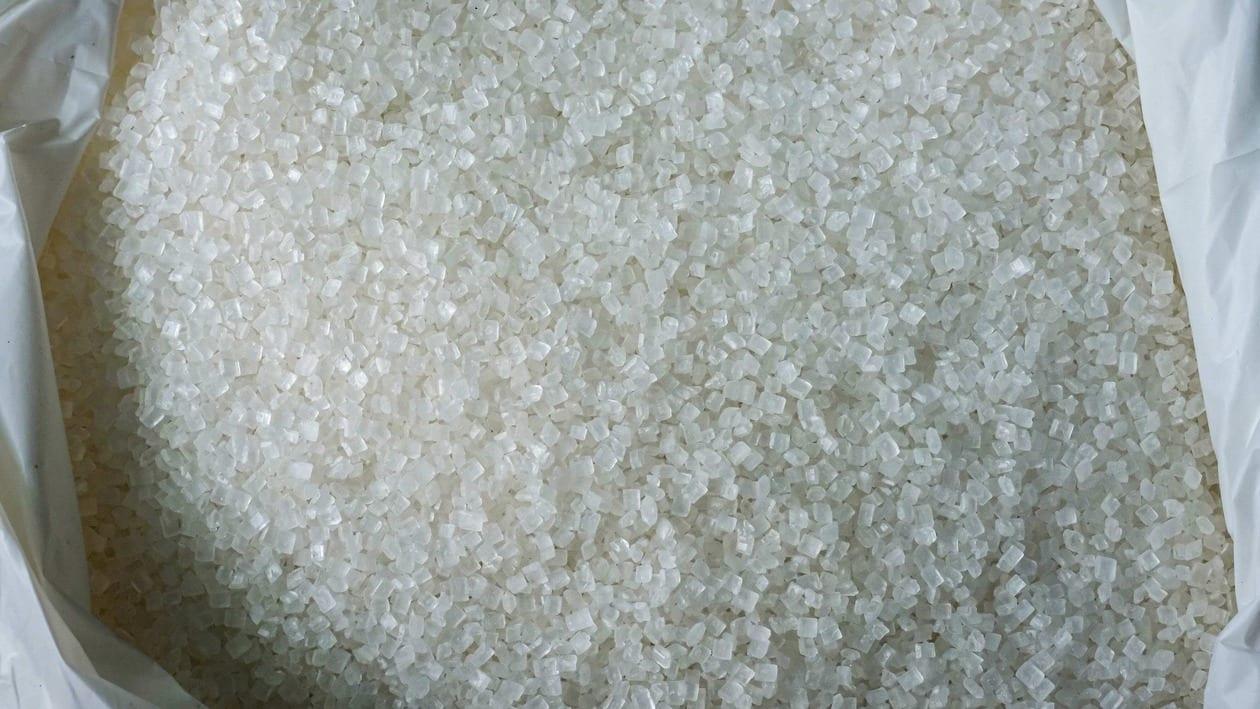

The government's latest move to restrict sugar exports for the first time in six years to prevent a surge in domestic prices has led to a panic selling in sugar stocks.

The government has capped sugar exports at 10 million tonnes, with no exports between June 1-October 31, 2022 (except under restrictive conditions). This has turned the market sentiment towards sugar firms and the industry outlook negative.

Shree Renuka Sugars has fallen around 19 percent, just in 3 sessions, since the announcement on May 24. Avadh Sugar and Energy and Dwarikesh Sugar Industries have lost 17 percent each, meanwhile, Balrampur Chini Mills declined 16 percent, Dhampur Sugar Mills shed 14 percent, and Magadh Sugar & Energy has also tanked 22 percent in this time.

The government said sugar mills and traders who have specific permissions from the government will only be able to export sugar (including raw, refined, and white sugar) till 31 October 2022 or until further orders. Additionally, the restriction is not applicable for exports to the European Union (EU) and the United States under CXL and TRQ (Tariff-Rate Quota) quota.

Market experts believe that the surge in inflation has created a sense of panic amongst traders and the latest export restrictions have led to a sharp fall in sugar stocks.

India along with Brazil are the two biggest producers of sugar. In FY22, India exported sugar worth $4.6 billion. This export ban is likely to lead to a fall in domestic sugar prices which helps the government's inflation cause but is likely to be negative for the industry as a whole.

"The export expectation from the country for the ongoing season was expected to be in the range of 9-9.5 Million Tons, however, the latest move should be seen as a precautionary measure to safeguard the country's own food supplies. As in any case exports were not expected to be happening beyond 10 Million Tons and the fact that the government is comfortable even at an inventory level of 6 Million Tons by end of September 2022 is positive. Hence we believe that it is a good step by the union government and we should not see any earnings impact because it is just the potential export restrictions and there is no ban on exports,” said Raj Vyas, Portfolio Manager, Teji Mandi in a contrarian view.

Going ahead, analysts believe that there is likely to be a relief rally once the restriction is lifted. But till then, the sector is likely to continue seeing downtrends. Moreover, most sugar stocks have already corrected 30-40 percent in the past few months, hence, it may be seen as a good opportunity for long-term investors to accumulate quality sugar stocks.