(PTI) Leading wine producer Sula Vineyards on Friday said it has raised ₹288 crore from anchor investors days ahead of its initial public offering (IPO).

The company has decided to allot 80,70,158 equity shares to anchor investors at ₹357 apiece, aggregating to ₹288.10 crore, according to a circular uploaded on the BSE website.

The capital was raised from 22 investors, including BNP Paribas Arbitrage, Morgan Stanley (Asia) Singapore Pte Ltd, Citigroup Global Markets Mauritius Pvt Ltd, Goldman Sachs and Abu Dhabi Investment Authority.

ICICI Prudential Life Insurance Company, HDFC Life Insurance Company, Aditya Birla Life Insurance Company, Max Life Insurance Company, Aditya Birla Sun Life Mutual Fund (MF), SBI MF and and HDFC MF were also among the anchor investors.

The public issue will be entirely an offer for sale (OFS) aggregating to 26,900,532 equity shares by the promoter, investors and other shareholders.

Those offloading shares through the OFS route are promoter, founder and CEO Rajeev Samant, and investors such as Cofintra, Haystack Investments Limited, Saama Capital III, Ltd, SWIP Holdings Limited, Verlinvest S.A and Verlinvest France SA.

The issue, with a price band of ₹340-357 a share, will open for subscription on December 12 and conclude on December 14. At the higher end of the price band, the IPO is expected to fetch ₹960.35 crore.

Investors can bid for a minimum of 42 equity shares and in multiples thereafter.

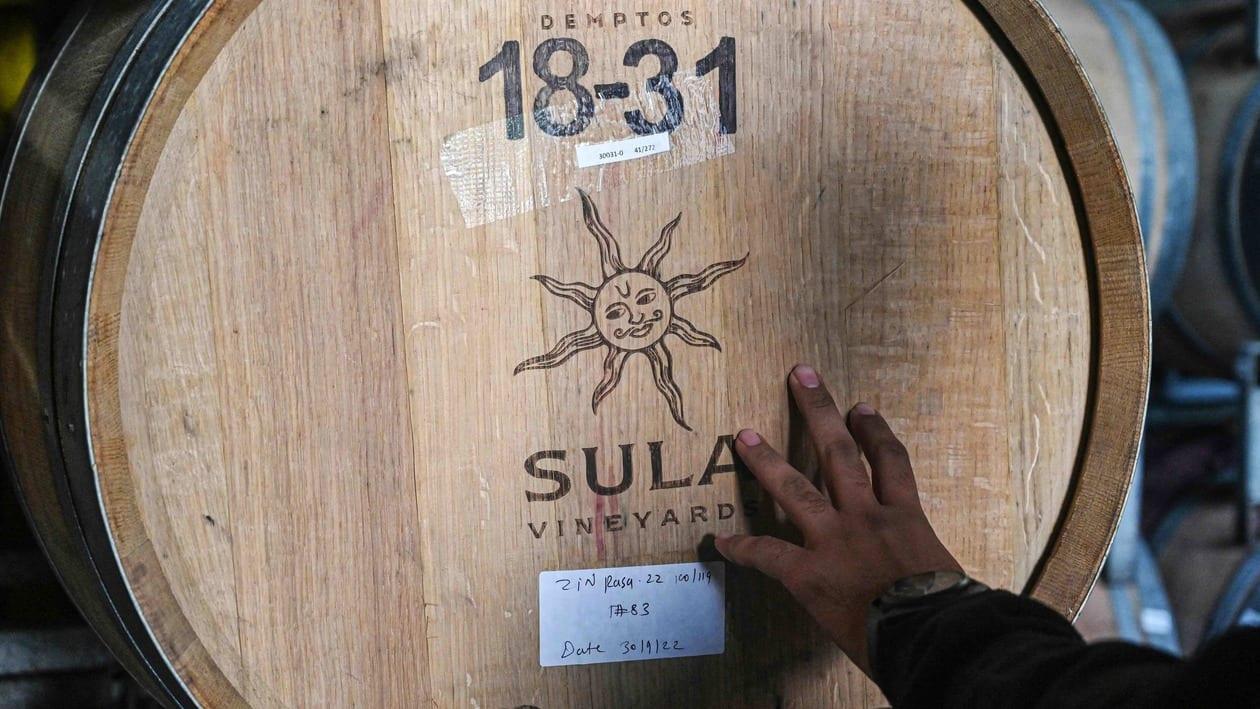

Sula Vineyards has been recognised as the market leader across wine variants, including red, white and sparkling wines. The company distributes wines under a bouquet of popular brands such as Sula (its flagship brand), RASA, Dindori, The Source, Satori, Madera & Dia.

Currently, it produces 56 different labels of wines across 13 distinct brands at its four owned and two leased production facilities located in Maharashtra and Karnataka.

The Nashik-based wine maker's profit after tax increased multi-fold to ₹30.51 crore for the six months ended September 30, 2022 from ₹4.53 crore a year earlier.

Its revenue from operations surged by 40.8 per cent to ₹224.07 crore for the six months ended September 30, 2022 from ₹159.15 crore registered in the same period of the preceding fiscal.

Kotak Mahindra Capital Company, CLSA India and IIFL Securities are the book running lead managers. The equity shares are proposed to be listed on BSE and NSE.

In 2018, Reliance Corporate Advisory Services, a wholly-owned subsidiary of Reliance Capital, sold a 19.05 per cent stake in Sula Vineyards for ₹256 crore.