Look at the budget recommendations and you will be incensed after finding out how the government has made no attempt to tweak the definition of capital gains nor has made any changes to the taxation of long-term capital gains (LTCG). However, an assessment also underscores how the recent Budget increased scope for traditional savings and investment options.

Take, for example, the maximum deposit Limit for Senior Citizen Saving Scheme which has been increased from ₹15 lakh to ₹30 lakh. Couple deposits would amount to ₹60 lakh from now as opposed to the earlier deposit amount limited to ₹30 lakh.

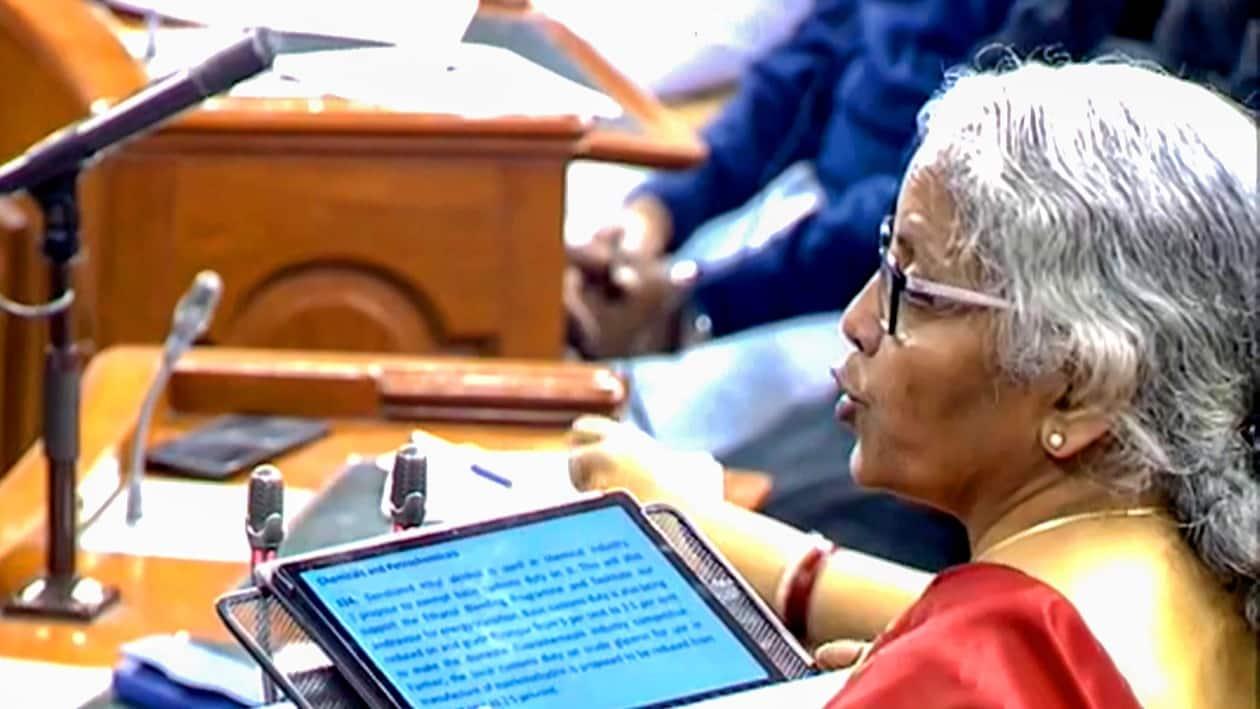

The government also announced a one-time Small Savings Scheme for Women. The maximum deposit amount in this scheme has been kept at ₹2 lakh while the interest rate has been fixed at 7.5 per cent every year. Apart, this scheme will have a partial withdrawal facility. The Finance Minister Nirmala Sitharaman announced, “One-time new small saving under ‘Mahila Samman Saving Patra’. The deposit facility for the women and girls will be for a period of two years with a rate of interest of 7.5 per cent.”

The limit on the postal monthly income scheme was also raised. In comparison to ₹4.5 lakh to date, ₹9 lakh can be invested from now in a single name, thus, allowing couples to save and invest up to ₹18 lakh.

The budget has been welcomed by middle and low-income taxpayers who still prefer to stick to traditional savings and investment options instead of putting their money in the market. However, does this imply that the current government is rerouting our focus to traditional investments?

Explaining the recent move of the government in augmenting people’s interest in traditional policies and investments, Tanvi Goyal, Founder, Wealth Aware says, “The government is largely trying to shift people away from traditional investment schemes in the following ways, firstly, by making the new tax regime the default option (unless people opt for the old regime) and providing tax exemption up to an income of ₹7.5 lakh under this new regime (including standard deduction), the government is trying to put more money in the hands of the masses. The new tax regime also does not have deductions under Section 80C of the Income Tax Act, so people do not feel obliged to make investments in financial products which do not align with their personal goals.

Secondly, the returns on insurance products which will be greater than 5 lakhs will not be tax-exempt (with an exemption for term plans). This will dampen the interest in traditional insurance policies. However, in the interest of women and senior citizens, the government has encouraged investment in traditional schemes by introducing Mahila Samman Saving Certificate for women and increasing the deposit limit for Senior Citizen Savings Scheme from 15 lakhs to 30 lakhs.”

As Vivek Iyer, Partner, Grant Thornton Bharat rightly puts it in his own words, “The budget continues to focus on financial inclusion - savings, investments and credit being the key components for financial inclusion. The infrastructure push and innovation focus create the platform for growth and wealth creation, which brings the investment schemes like mutual funds back into focus.”

Adding to this, Priyanka Wadhwa, Co-Founder & Chief Strategy Officer, CommsCredible says, “The Union budget 2023-24 has come with a slew of economic reforms. The Finance Minister announcing a raise in deposit limits under the Senior Citizens Savings Scheme (SCSS) and Post Office Monthly Income Scheme (POMIS) is one such welcome move. This will not only provide relief to senior citizens but also once again puts the spotlight on the significance of traditional investment schemes. The enhancement of limits in these schemes will help in bringing succour to investors in times of rising inflation. It will provide a regular flow of income and give better risk-free returns as well.”

Traditional investment options are here to stay, especially, with the rise in people’s interest in them due to increased savings limit and better interest options. The new budget 2023 guidelines coupled with increasing deposit rates offered by banks and fintech organizations have prompted many investors to rethink their idea of entering the market to gain returns, especially, in the current turmoil when even some of the best stocks are touching new lows every week.