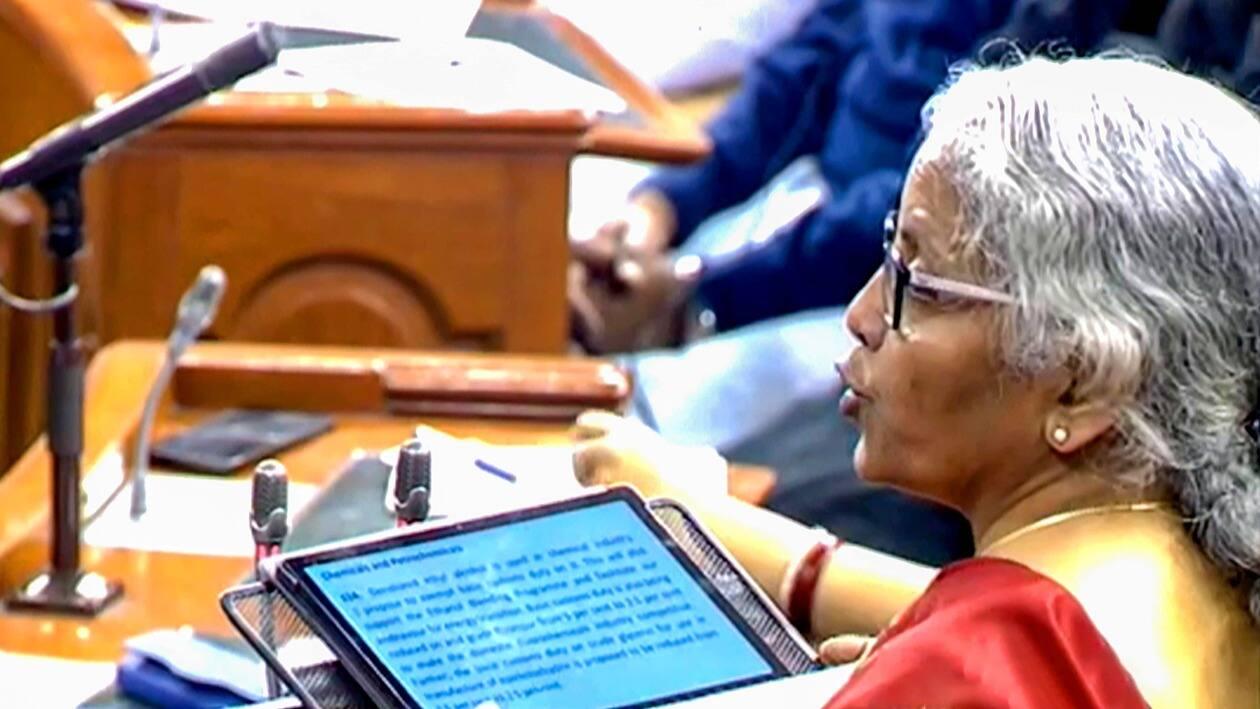

Senior citizens have a lot to rejoice with as the Union Finance Minister Nirmala Sitharaman announced reforms in the Budget 2023, allowing senior citizens to save and invest more for their future. The maximum deposit level of the Senior Citizens' Saving Scheme (SCSS) has been enhanced from ₹15 lakh to ₹30 lakh. The minimum deposit for the scheme continues to be pegged at ₹1,000.

For the quarter ending March 31, 2023, the government has raised the interest rate on the SCSS to 8%.

“The government has announced an 8% rate of return on the Senior Citizen Savings Scheme for the quarter Jan-March 2023. The Union Budget 2023 has proposed to increase the maximum deposit permitted under this scheme from ₹15 lakhs to ₹30 lakhs, moving towards safe and assured higher return than FDs or saving accounts for resident senior citizens," said Akhil Chandna, Partner - Tax, Grant Thornton Bharat.

Most retired people turn into conservative investors post retirement. The increase in the savings and investment limit up to ₹30 lakh at the given interest rate would translate to decent earnings as interest income.

The scheme matures in five years though one may seek an extension by another three years, thus, taking the total investment tenure to eight years. Premature withdrawal is also allowed, thus, allowing investors to withdraw some amount in the event of an emergency.

The Finance Minister also announced enhancing the maximum deposit limit for the monthly income accounts scheme from ₹4.5 lakh to ₹9 lakh for single accounts, and ₹9 lakh to ₹15 lakh for joint accounts.