Buy a medical insurance is imperative is a foregone conclusion. It covers everything from a sudden illness to a serious accident. However, some of us may not be aware that in spite of taking a medical insurance, hospital bills can still burn a hole in the pocket.

There could be a slew of reasons for this including exclusion of pre-existing diseases, or some serious ailments such as cancer which is perhaps not covered by the usual vanilla medical insurance policy.

Some of us must have noticed the tiny difference between the approved amount and the claim applied for. Since the difference is diminutive, we are not accustomed to paying much attention. But the pandemic happened and things were turned on their head.

Before we proceed further, let us first understand what those ‘extras’ are!

What are consumables?

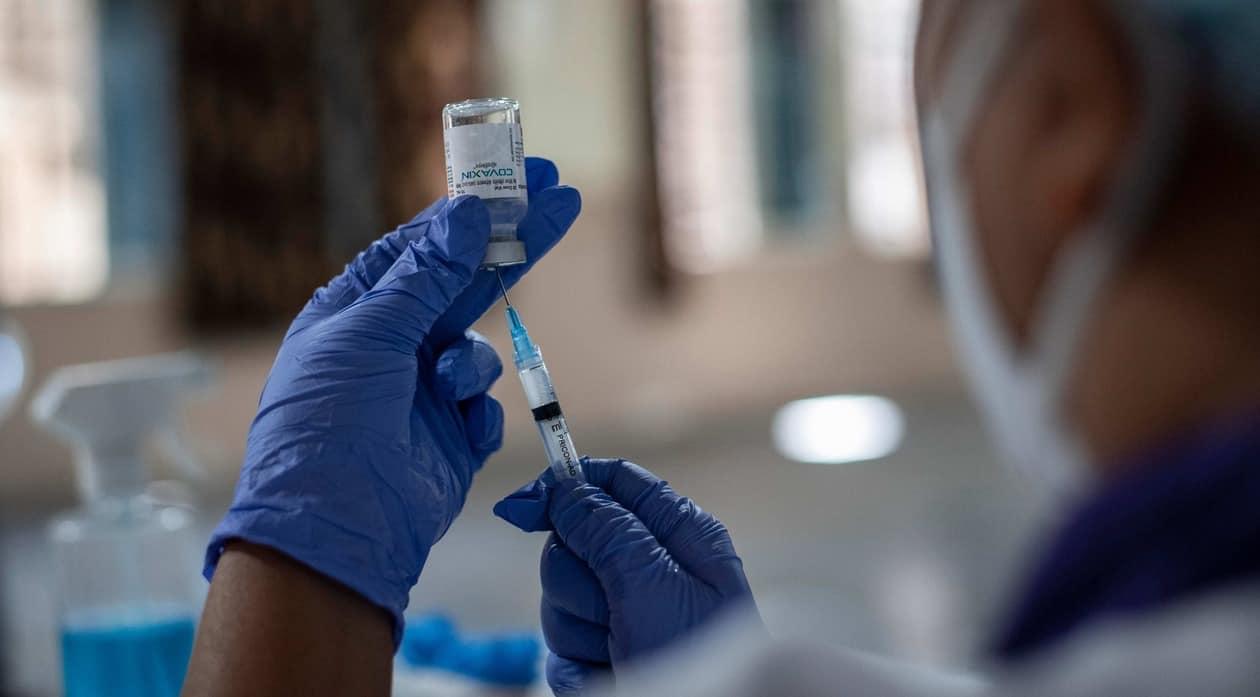

Consumables are pharmaceutical items that need to be discarded once used such as masks, PPE kits, gloves, syringes, crepe bandages, etc. During the pandemic, hospitals made it mandatory for its staff to wear protective gear during the pandemic while treating Covid patients. This raised the proportion of consumables in the total medical bill.

An SBI report states that the consumable bill made nearly 3 to 5 percent of the medical bill before the pandemic. But this proportion jumped significantly during the pandemic when the ratio of consumables spiked to 25 to 30 percent.

So, we can say that it is imperative to factor in the cost of consumables while buying medical insurance.

To prevent extra out-of-pocket expenditure while making claims, it is vital to buy riders that can cover consumables. Aside from offering coverage for consumables, these riders also keep No-Claim Bonus (NCB) safe, as long as the claim during the year is below ₹50,000.

At the same time, some riders pay for preventive health, wellness benefits, check-ups, home care, diagnostics and doctor consultations.

Another factor that policyholders must keep in mind is the increase in inflation. Usually, policyholders continue a policy year after year, without increasing the policy cover to raise it in alignment with inflation.

Some insurers offer riders to cover consumables, and are also inflation-linked, which means each year the policy net expands to cover inflation. For instance, Care Insurance offers Care Shield rider that covers consumable and rises with inflation.

So, we can say that buying extra riders for consumables and for factoring in inflation can spare policyholders from needless hassle, inconvenience and importantly – higher medical bills.