“Risk hai toh Ishq hai” is the most common phrase used in investing parlance. However, does the idea of taking only risk and not balancing it with adequate reward help gain in the long run? Not all risks are worth considering, which means the tendency to take any unwanted risk unwarrantedly out of impulse or social media influence will always backfire in the long run.

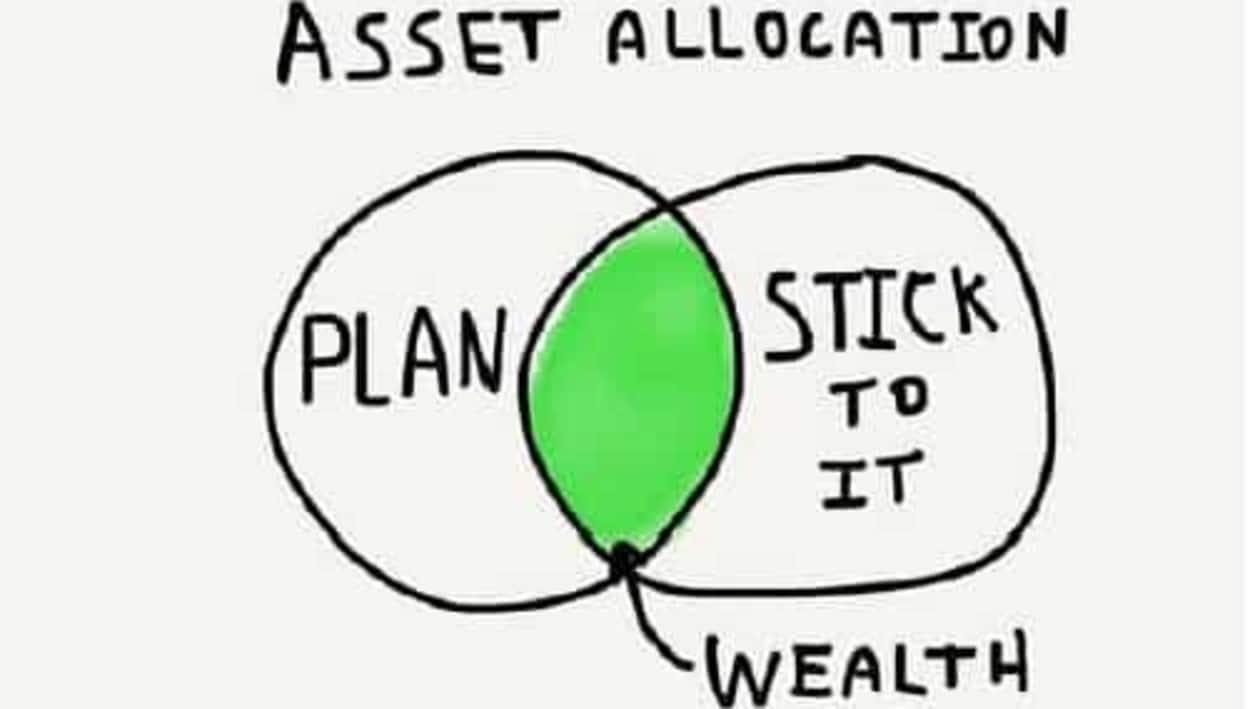

The best way out of this is to ensure a proper focus on asset allocation – An investment style that is adopted to balance risk and reward by allocating assets in a portfolio. However, a lot depends on individual financial goals, risk tolerance, understanding of finances and investment horizon.

While choosing the right asset allocation, you may choose between equities, debt and fixed-income instruments including bank deposits, gold, real estate and more. There is no standard formula to decide the right asset allocation considering what works for one may not yield the desired results for another.

Why resort to asset allocation?

Many personal finance professionals opine how choosing the right asset allocation is one of the most important decisions that investors must take while deciding to park their finances for better returns. This is because many people choose their stock and fund investments based on past-year returns without realizing how their past performance is no guarantee of future results. The tendency to jump from one investment to the other without lending it enough time to perform and earn the desired returns is another mistake that many investors make.

Salonee Sanghvi, Founder, My Wealth Guide says, “We often land up investing on the basis of what a friend suggested or something we saw on TV. Just like it's important to have a balanced meal it's important to have a balanced allocation to different asset classes like equity, debt, gold, real estate, etc. Money is supposed to give you security not sleepless nights. So, if you are not comfortable with too much risk you will become very anxious if your portfolio is down 30 per cent but someone who is more aggressive will be ok. Similarly, if you have a goal that is only two to three years away you cannot allocate to equity because if the markets are down that year you will not have enough to find that goal. So, when you start investing look at how much risk you're willing to take and how far from your goal you are. The longer the duration and higher the risk, the higher the proportion of equity. Shorter the duration, lower the risk, more debt in the portfolio.”

Distinct allocations for different investors

Not all have the same idea of financial goals. The definition of financial independence does not hold true for everyone. This is because not all investors enjoy access to similar earnings nor bear similar responsibilities. This explains why not all investors resort to the same asset allocation strategy.

For example, some investors may be saving up for a new car in the coming year, thus, explaining their judicious choice of investments that includes cash set aside in bank deposits, certificates of deposit (CDs) and short-term bonds. Then, those saving for retirement in the coming two to three decades may plan ahead by investing a majority of their earnings in their retirement funds, index funds, the National Pension Scheme, pension plans, long-term bonds and dividend-yielding stocks considering the prolonged period they have at their disposal to weather short-term market volatility.

Viral Bhatt, Founder, Money Mantra says, “Personalization is important. Everyone has unique financial goals, risk tolerance, and time horizon, which means that a one-size-fits-all approach to asset allocation is not appropriate. By creating your own strategy, you can tailor it to your specific needs and circumstances. Following someone else’s financial decisions may not lead to long-term success. A strategy that worked for someone else may not work for you, and blindly following their lead could lead to poor results. By planning your own asset allocation strategy, you can take a long-term view and make investment decisions that align with your goals.”

You do not decide your asset all of a sudden. A lot of thought and deliberation goes into deciding where you must invest and what you must avoid. Asset allocation is a key factor in developing and balancing an investment portfolio. Ultimately, this is one of the most important factors influencing overall returns. Creating the right mix of assets in a portfolio of stocks, bonds, cash and real estate is a fluid process. Therefore, your asset mix should always reflect your financial goals.