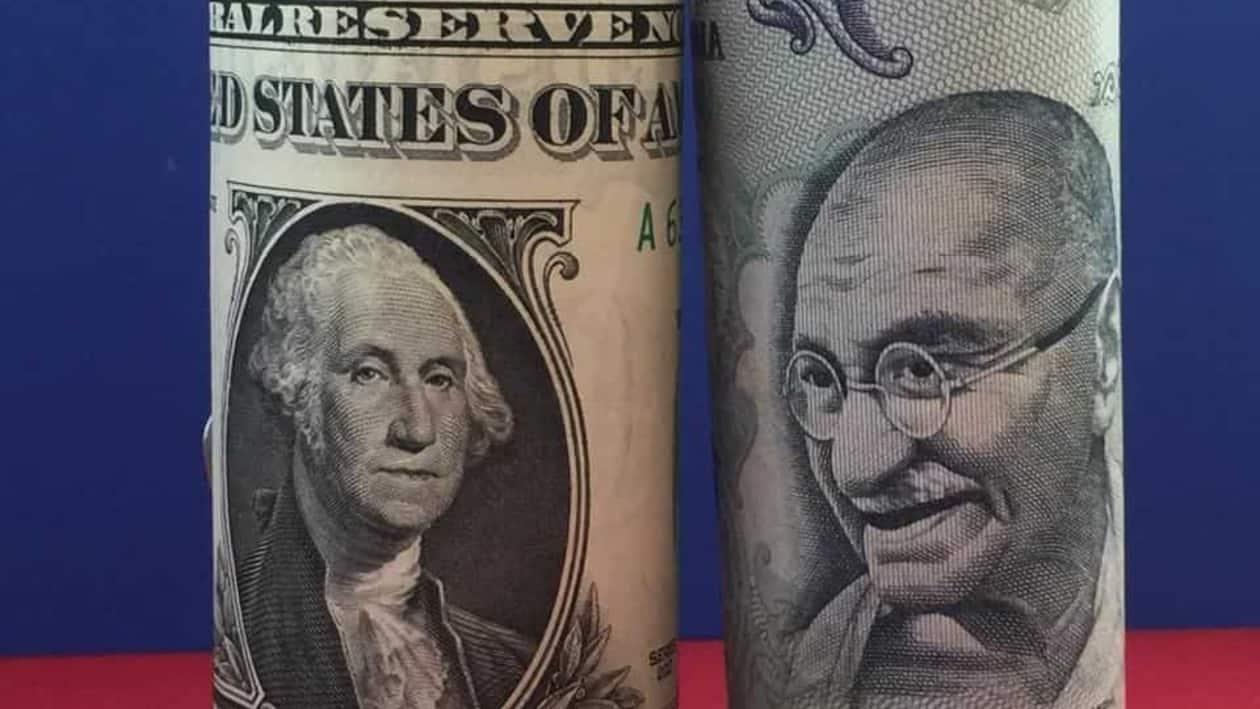

After nine months of continuous selling, foreign investors turned net buyers in July, buying worth ₹4,989 crore in Indian equities in July on softening dollar index and good corporate earnings. This comes after the foreign investors sold ₹50,145 crore in June, the highest since March 2020 when the FPIs had pulled out ₹61,973 crore.

In 2022 so far, foreign investors have sold worth ₹2,12,369 crore.

According to experts, the reversal in the trend comes on the back consolidation in commodity prices, decent earnings by India Inc, and positive growth commentary by the US Fed as well as the RBI.

"With expectations that the US Fed is not very far away from peak interest rates due to the emerging slowdown in US and Europe, FIIs inflows turned positive in July. Another factor that has helped India is the expectation that India is one of the few countries still having a fairly robust growth outlook for the coming year, unlike most other major economies expected to slow down significantly," Nishit Master, Portfolio Manager, Axis Securities.

The turning point for the net flows in July was US Federal Reserve Chairman Jerome Powell's statement that currently the US is not in a recession helped improve sentiments and risk appetite globally.

Also, softening of the dollar index and good quarterly earnings from financials have helped in improving the sentiments, VK Vijayakumar, Cheif Investment Strategist at Geojit Financial Services, said.

Will this trend continue in August?

Analysts say it's possible.

According to Siddharth Bhamre of Religare Broking, it is very possible that the positive foreign investor trend will continue in August. He noted that the US Fed commentary that the interest rate hike will not be very aggressive led to a positive sentiment across markets.

Further, the inflation in India is around 7 percent and on a downward trend which is also a positive going ahead. He does not expect any major hike in the August policy review. Bhamre also noted that the foreign investor buying happened in the second half of July, also the foreign investors are not only buying in cash but also forging fresh positions in index futures and when the foreign investors start that, then market goes up. He also noted that more headroom is left for markets to go up.

Master of Axis Securities also believes that the trend of positive FII inflows can continue in August as long as the market believes that the US interest rate peak is not far away and there is no major negative news emerging from Europe.

Vinit Bolinjkar, Head of Research, Ventura Securities, however, said that considering the global uncertainties and geopolitical tension in Europe, it would be too early to predict the timeline for the recovery. We would recommend that investors remain invested in fundamentally sound stocks and buy on dips, he added.

Foreign investors started their outflows in last year. Between October 2021 till June 2022, they sold a mammoth ₹2.46 lakh crore in the Indian equity markets.

However, FPIs pulled out a net amount of ₹2,056 crore from the debt market during the month under review.

5 reasons why FPIs turned positive in July, according to Vinit Bolinjkar of Ventura Securities:

Pause in rate hike:

Fed has increased the interest rates (by 150 bps in the past couple of meetings) at a more rapid pace than other central banks around the world. It has resulted in a slowdown in spending and production in the US and hence Fed has indicated a pause or a slowdown in a rate hike. However, the past hawkish behaviour of the Fed has impacted the emerging market currencies and their stock markets. Now with the less-hawkish communication by the Fed and pause in interest rate hikes, the recovery in emerging markets should continue.

Easing global food inflation

Falling prices for Agri commodities such as wheat or corn are set to slow the global consumer food prices and ease the pressure on global food inflation. Egypt which used to import a significant quantity of wheat from Ukraine has now diversified its procurement and started importing from multiple countries such as France, Romania, etc. A recent agreement between Russia and Ukraine allowing exports of Ukrainian wheat could also help cool global prices.

Stable steel prices

The global steel prices corrected since May 2022 due to weak demand and a supply glut. China has been declining its steel production to arrest the falling prices, however, the recovery in steel prices is expected to remain slow due to weak global demand from the infrastructure and construction sector. Stable steel prices will ease metal inflation.

Positive FIIs flow in emerging markets

Collectively, less hawkish communication by the Fed, easing inflation and oversold equities have made emerging markets again attractive for FIIs and we believe the recent recovery will continue. In India, after a series of negative outflows since Oct 2021, FIIs turned positive in Jul 2022 (net inflow of INR 4,989 cr)

Stable INR and favourable business environment in India

Compared to other Asian currencies, INR remained more stable. The RBI, too, has stepped in via forex market interventions to manage volatility. Besides, India was less vulnerable to the Russia-Ukraine crisis and the only risk was from the Fed rate hike. Now with the slowdown or pause in a rate hike and a favourable business environment, we believe that the recovery in the Indian market would be faster.