The stocks of financial services and fast-moving consumer goods (FMCG) companies accounted for the maximum foreign portfolio investor (FPI) buying during the second fortnight of December last year, market daily Business Standard informed in a report.

FPIs bought finance stocks worth ₹2,806 crore, and FMCG shares worth ₹1,370 crore, according to data collated by PRIME Infobase, said the report.

Consumer services ( ₹974 core), metal and mining ( ₹277 crore), and power ( ₹177 crore) were the other sectors FPIs parked their money in the last two weeks of December 2022, it added.

Rising credit growth and falling non-performing assets are attributed as reasons for the bullishness towards finance stocks, noted the market daily while adding that FMCG stocks are considered defensive bets whenever there is global financial turmoil.

Alternatively, FPIs dumped information and technology stocks worth ₹2,265 crore, and chemical stocks worth ₹620 crore, informed BS.

As of December 31, 2022, the highest sectoral allocation was to financial services at 32.95 percent, from 32.69 percent on December 15, 2022, followed by oil, gas, and consumable fuels at 11.44 percent, it said.

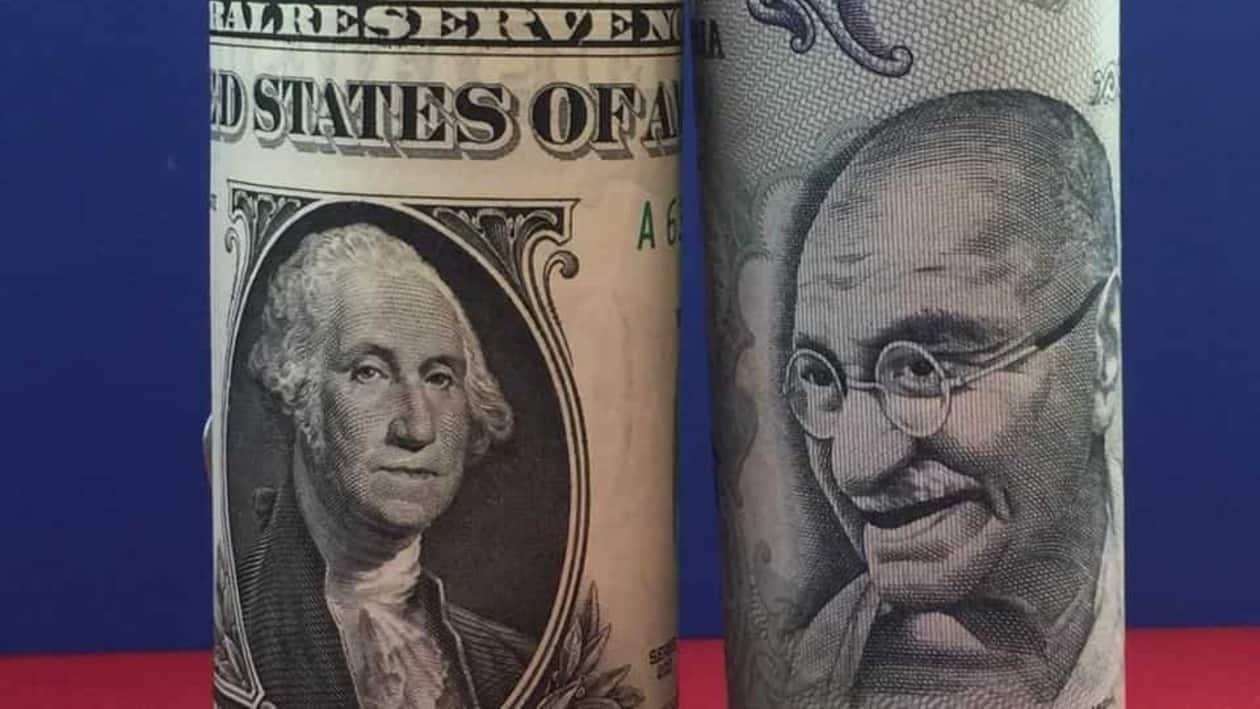

Overall, foreign investors pumped in ₹11,119 crore in the Indian equities in December, making it the second consecutive monthly inflow, despite increasing concerns over the re-emergence of Covid-19 cases in some parts of the world.

However, foreign portfolio investors (FPIs) had turned cautious in the last month. The inflow in December was much lower compared to ₹36,239 crore invested by FPIs in the month of November, data with the depositories showed.

"Despite correction in the markets, increasing concerns over re-emergence of Covid in some parts of the world and recession worries in the US. FPIs remained net buyers in the Indian equity markets (in December)," Himanshu Srivastava, Associate Director - Manager Research, Morningstar India, said.

In 2022, FPIs have made a net withdrawal of ₹1.21 lakh crore from the Indian equity markets in 2022 on aggressive rate hikes by the central banks globally, particularly the US Federal Reserve, volatile crude, rising commodity prices along with the Russia-Ukraine conflict.