(Bloomberg) -- Hedge funds are unleashing record bets the Federal Reserve will stick to its hawkish script at Jackson Hole to rein in the fastest inflation in four decades.

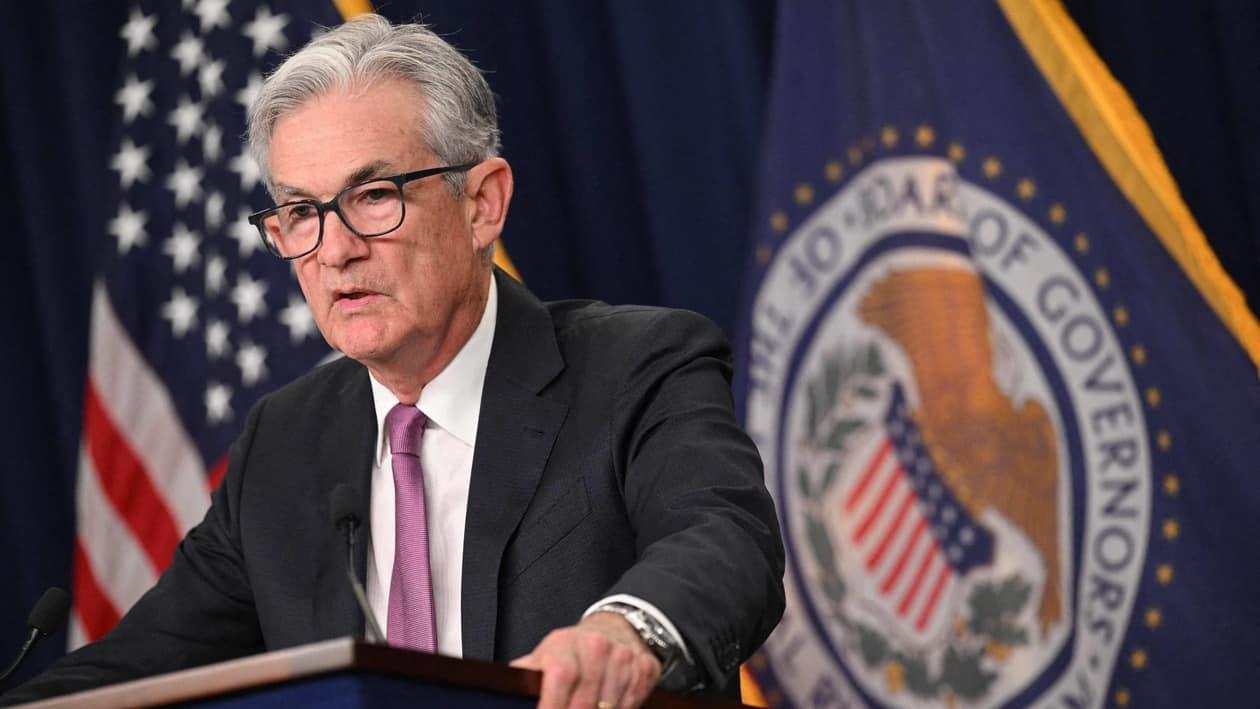

The group has collectively placed a big short across futures for a key overnight rate that moves in line with the Fed’s benchmark. The position will benefit if Fed Chair Jerome Powell effectively rules out a dovish pivot when he speaks at this week’s symposium. The short position has more than tripled in the past month, even as the futures market are predicting interest-rate cuts next year.

Rates and bond markets are being roiled as central bankers deploy the steepest rate hikes in a generation to try and tame inflation. Treasuries slid to a record 9% loss in the first half, before posting the biggest gain in more than two years last month as investors turned hopeful that inflation is nearing its peak.

“We’re going to get more of this sawtooth price action that we’ve been seeing over the past three or four months where the market continually tries to pick the peak in the rate cycle, and then backs up again when they worry central banks are going to do more,” said Sean Keane, managing director of Triple T Consulting Ltd.

Yields on policy-sensitive two- and three-year Treasuries both jumped more than 10 basis points in intraday trade Monday, before pulling back into the close, while the 10-year yield climbed above 3% for the first time in a month. The benchmark yield was little changed Tuesday at 3.10%

The past two sessions have seen traders build up large put structures to target a move in 10-year yields to as high as 3.70% within a month. The buying continued Monday, although shifting from October options out to November maturities.

The net-short positioning for futures on the Secured Overnight Financing Rate -- the official successor to London interbank offered rate -- rose to an unprecedented 695,493 contracts in the latest Commodity Futures Trading Commission data. That’s the equivalent of around $17 million of cash risk on the table per-basis-point move.

Eurodollar Futures

Meanwhile, short wagers from hedge funds for eurodollar futures are the highest this year at just over 2.6 million contracts, on a net basis. The fate of these wagers lies in the immediate path of policy rates. The swaps market is roughly pricing in a 50/50 chance the Fed will hike by 50 or 75 basis points at its Sept. 20-21 meeting.

“Market opinion initially was split last week about whether the FOMC minutes were hawkish or dovish,” said Lou Crandall, economist at Wrightson ICAP LLC. “There won’t be any such ambiguity about Chair Powell’s Jackson Hole speech on Friday.”

Bets on a dovish pivot have diminished over the past week, with the December 2022/December 2023 SOFR inversion signaling about a quarter-point cut next year, down from the three seen over a month ago.

There’s little prospect of relief from the market turmoil given the severe inflation conundrum central banks face, according to Triple T Consulting’s Keane. “This is going to be with us for a long while, because until unemployment rises in major economies you’re not going to see the drop off in demand that’s necessary to lower sticky, domestic inflation,” he said.