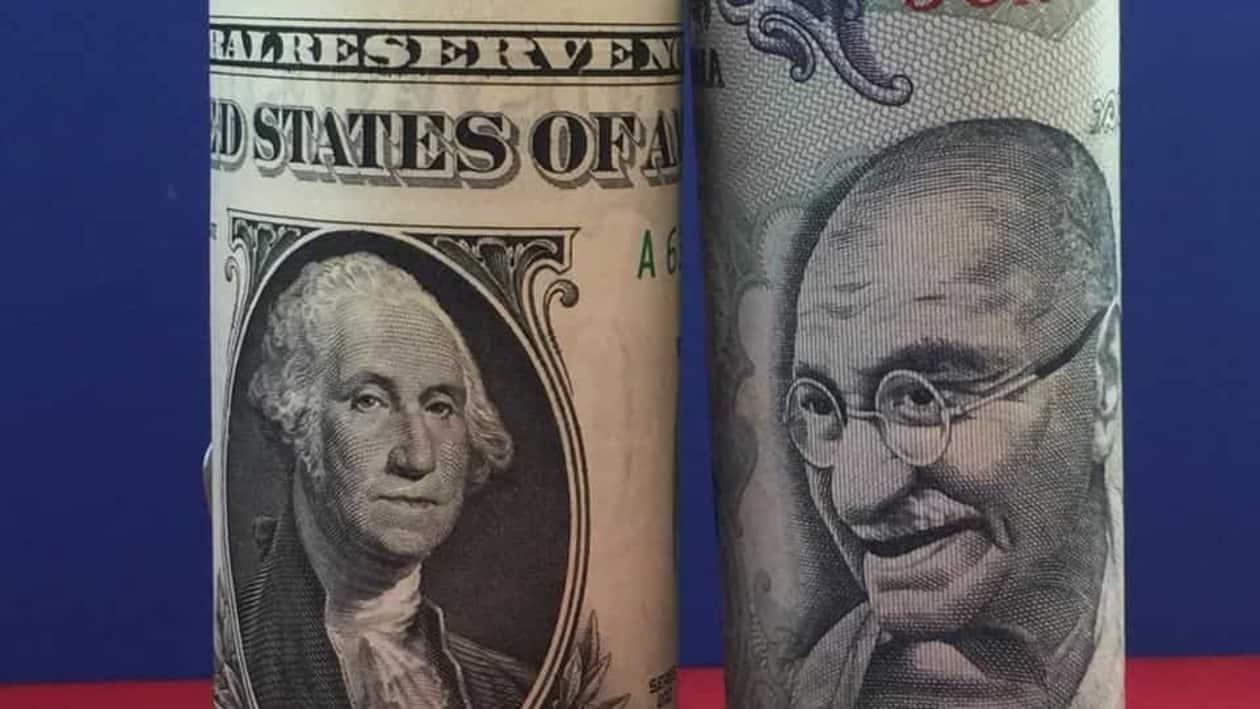

(Reuters) The Indian rupee gained against the dollar on Friday, as the Chinese yuan's sharp rise lifted sentiment across Asia.

The rupee was up 0.5% to 82.48 per dollar, tracking the onshore yuan's 0.9% jump.

Chinese stocks and the yuan jumped on reports of early progress in U.S. checks on Chinese company audits and hopes for COVID restrictions to be relaxed.

"There was some correction in crude oil prices overnight, but the biggest reason for rupee's move is gains in Asian currencies, particularly the yuan," said Dilip Parmar, research analyst at HDFC Securities.

If rupee stays on track, it could recoup all of this week's losses to close little changed or marginally higher.

Asian currencies rallied, with the Thai baht and the Philippine peso up 0.9%, rebounding from losses earlier this week after the Federal Reserve's stance that U.S. rates could peak higher.

Brent crude futures fell to under $95 per barrel overnight on fears over higher U.S. interest rates but are now up 1.4% as China relaxing curbs is likely to boost demand for the commodity.

Meanwhile, the dollar index dropped 0.4% by mid-morning trade, having shot up last night. It is still headed to post its best week in over a month.

Fed rate futures now point to a terminal rate of about 5.15% by June, with U.S. Treasury yields moving in step with the higher expectations.

Markets now await U.S. non-farm payrolls data due later in the day to gauge labour market conditions in the country.