Samhi Hotels made a decent debut on the bourses today, September 22, 2023. The stock listed at ₹134.50 on the NSE, a 6.75 premium to its IPO price of ₹126. Meanwhile, on the BSE, it listed at ₹130.55, a 3.6 percent premium.

The ₹1,370 crore initial public offering (IPO) was open for bidding between September 14 and on September 18 at a price band of ₹119-126 per share.

The issue was overall subscribed to 5.57 times. The allocation for qualified institutional bidders (QIBs) was booked 9.18 times, while the portion for non-institutional investors fetched 1.29 times bids. The portion reserved for retail investors was booked 1.17 times at the end of bidding.

The IPO consisted of a fresh equity sale worth ₹1,200 crore and an offer-for-sale (OFS) of 1.35 crore equity shares amounting to ₹170 crore by Blue Chandra, Goldman Sachs Investments Holdings (Asia) and GTI Capital Alpha. Compared to the DRHP, the company has increased the fresh issue size from ₹1,000 crore to ₹1,200 crore.

Net proceeds from the issue shall be utilised towards repayment or prepayment of borrowings by the company or its subsidiaries, and general corporate purposes.

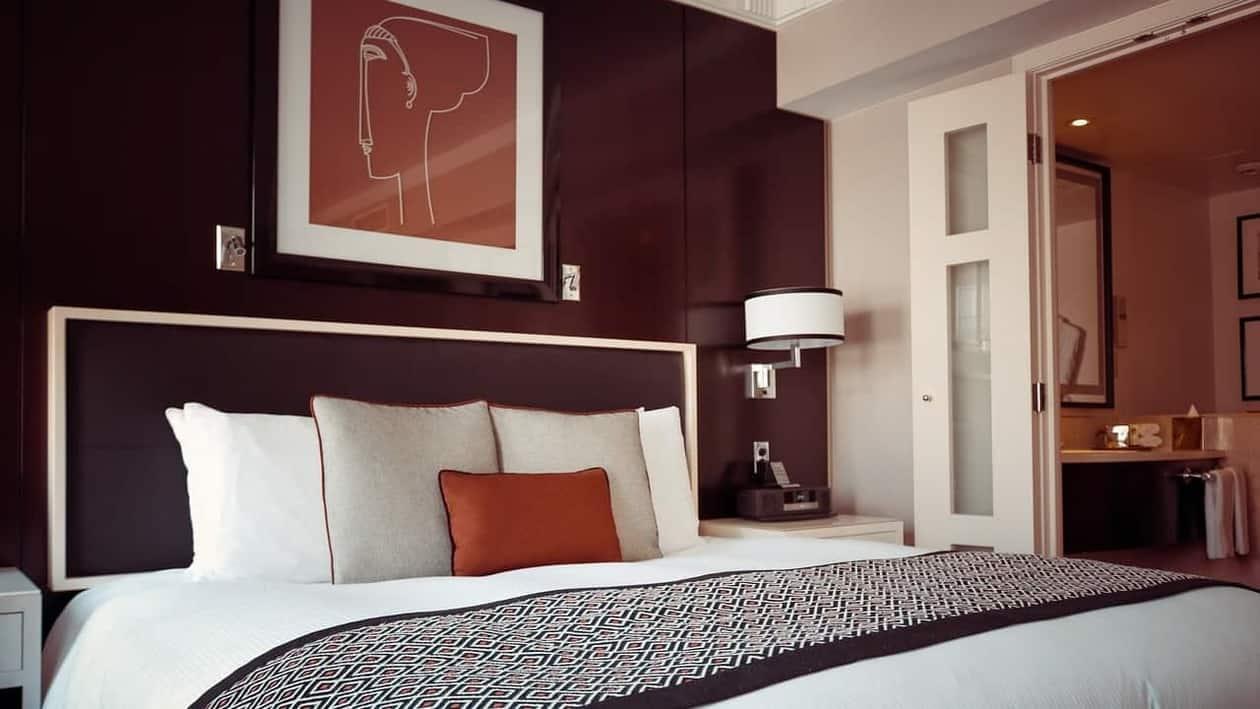

Incorporated in 2010, SAMHI Hotels is a professionally managed branded hotel ownership and asset management platform in India. SAMHI's hotels operate under well-recognised hotel operators such as Courtyard by Marriott, Sheraton, Hyatt Regency, Hyatt Place, Fairfield by Marriott, Four Points by Sheraton, and Holiday Inn Express.

Within 13 years of its inception, SHL became India’s 3rd largest hotel owner by number of rooms (owned and leased). It is the largest multi-brand hotel owner and has a portfolio of 3,839 hotel rooms across 25 operating hotels in key urban consumption centers like Bengaluru, Hyderabad, National Capital Region, Pune, Chennai and Ahmedabad.

For the year ended on March 31, 2023, SAMHI Hotels reported a net loss of ₹338.59 crore against a net loss of ₹443.25 crore in FY22. Meanwhile, its total revenue from operations soared 128 percent to ₹761.43 crore versus ₹333.10 crore in the previous year ended March 2022.

Over FY20-23, SHL reported a mixed set of performance. Its operating performance was robust, mainly due to improved occupancy levels and higher hotel room rents. However, financially, it reported a net loss during the period. FY21 and FY22 operations were impacted by the Covid-19-led travel restrictions. The company reported a 6.8 percent compound annual growth rate (CAGR) growth in the consolidated operating revenue to ₹738.6 crore in FY23.

Most brokerages were cautious on the issue amid concerns regarding profitability, expensive valuations, weak financials and seasonality in operational performance.

SAMHI Hotels is currently a loss-making hospitality company. The company's financial performance has been poor for the last three years, but it is making progress in cutting losses. However, business is subject to seasonal and cyclical variations that could result in fluctuations in the results of operations, Swastika Investmart said, adding, “as the company is in financial trouble, we won't apply for this IPO.”