Domestic equities logged healthy gains on December 13, in light of positive global cues while investors are awaiting US inflation prints.

Investors' risk appetite improved globally ahead of the US inflation data, which is expected to have fallen. A softer inflation print may give comfort to the Fed to decrease the pace of rate hikes.

"Headline consumer price pressures for November in the world's largest economy are expected to have fallen for a fifth successive month. The core consumer price index is expected to have risen by 6.1 percent in November from October's 6.3 percent, while headline inflation is forecast to have fallen to 7.3 percent from 7.7 percent," reported Reuters.

A fall in domestic inflation numbers also supported market sentiment. At 5.88 percent, India's retail inflation, or the consumer price index (CPI) based inflation, fell below the RBI's upper tolerance level of 6 percent for the first time in 11 months in November.

However, while inflation eased in November, India's industrial production shrank 4 percent in October. Investors hope falling inflation and shrinking industrial production may make RBI take a pause on rate hikes in its next policy meet.

"Markets were on a firm footing on the back of short covering as retail inflation easing to an 11-month low raised hopes that the rate hike regime could slow down and take a pause going ahead. Also, overnight gains in the US markets further aided the local market sentiment, which had slipped into a range-bound mode over the past few sessions," said Shrikant Chouhan, Head of Equity Research (Retail) at Kotak Securities.

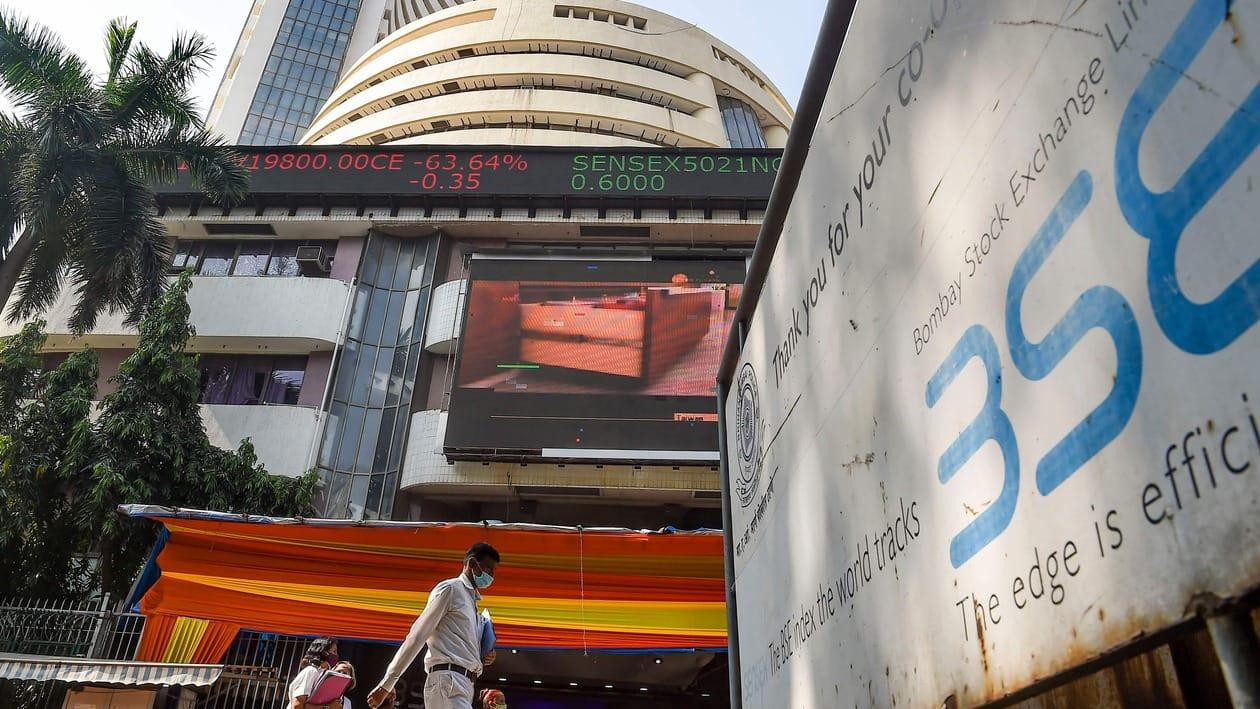

Equity barometer Sensex closed 403 points, or 0.65 percent, higher at 62,533.30 while the Nifty50 clocked a gain of 111 points, or 0.60 percent, to end at 18,608.

Mid and smallcaps also rose but underperformed the benchmarks. The BSE Midcap index rose 0.25 percent while the Smallcap index clocked a gain of 0.40 percent.

The overall market capitalisation of BSE-listed firms jumped to ₹290 lakh crore from ₹288.4 lakh crore on December 12, making investors richer by ₹1.6 lakh crore in a single session.

Shares of IndusInd Bank, Bajaj Finance and Infosys ended as the top gainers while those of Nestle, Tata Steel and Maruti ended as the top laggards in the Sensex index.

Among the sectoral indices, the Nifty PSU Bank index surged 3.81 percent. The IT index clocked a decent gain of 1.12 percent. Nifty Realty, on the other hand, fell 0.80 percent.

As many as 171 stocks, including Axis Bank, Britannia Industries, CG Power and Industrial Solutions, YES Bank and Punjab National Bank, hit their 52-week highs in intraday trade on BSE.

Crude oil prices rose underpinned by hopes of improved demand amid China's easing Covid curbs. Brent Crude rose over a percent higher to trade near the $79 per barrel mark.

China's loosening Covid-19 rules would likely lead to higher oil demand and in turn prices might increase by around $15 per barrel, Reuters reported, quoting Goldman Sachs.

The rupee fell 27 paise to close at 82.81 per dollar after the greenback gained ahead of the US inflation numbers later on December 13 and the FOMC meeting outcome on December 14.

Technical views by analysts

Chouhan pointed out that the market not only reclaimed the 20-day SMA (simple moving average) level but also closed above it which is broadly positive.

"The bullish candle on daily carts and promising reversal formation is indicating the continuation of an uptrend wave in the near future. The uptrend texture is likely to continue in the near future and 18,700-18,725 would be the next resistance zone for the bulls. On the other hand, a fresh selloff could be seen only after the dismissal of 18,450," said Chouhan.

Nagaraj Shetti, Technical Research Analyst at HDFC Securities observed a reasonable positive candle was formed on the daily chart which is indicating a comeback of bulls after a small downward correction.

Shetti underscored after an attempt at a downside breakout of the support at the 18,550 level on December 9, the market failed to show follow-through weakness in the next couple of sessions. He said this pattern indicates a false downside breakout of the support and such actions more often result in sharp upside movement.

"The short-term trend of Nifty continues to be positive and a sustainable move above the hurdle of 18,650 is expected to be an upside breakout of the crucial overhead resistance. The said upside breakout is likely to open doors for new all-time highs in the near term. Immediate support is placed at 18,500 levels," said Shetti.

Key market data

Disclaimer: The views and recommendations given in this article are those of individual analysts. These do not represent the views of MintGenie.