Shares of Rail Vikas Nigam, a railway infrastructure company, opened higher in Wednesday's trade after the company received a letter of award for appointment as the project implementation agency for the UTF Harbor project in Maldives. The cost of this strategic governmental project is estimated at ₹1,544.60 crore.

Following the development, the stock began the trade with a gap-up of ₹65.50 apiece as against a previous close of ₹63.55. The stock climbed further in the early trade and rose 5 percent to ₹66.70.

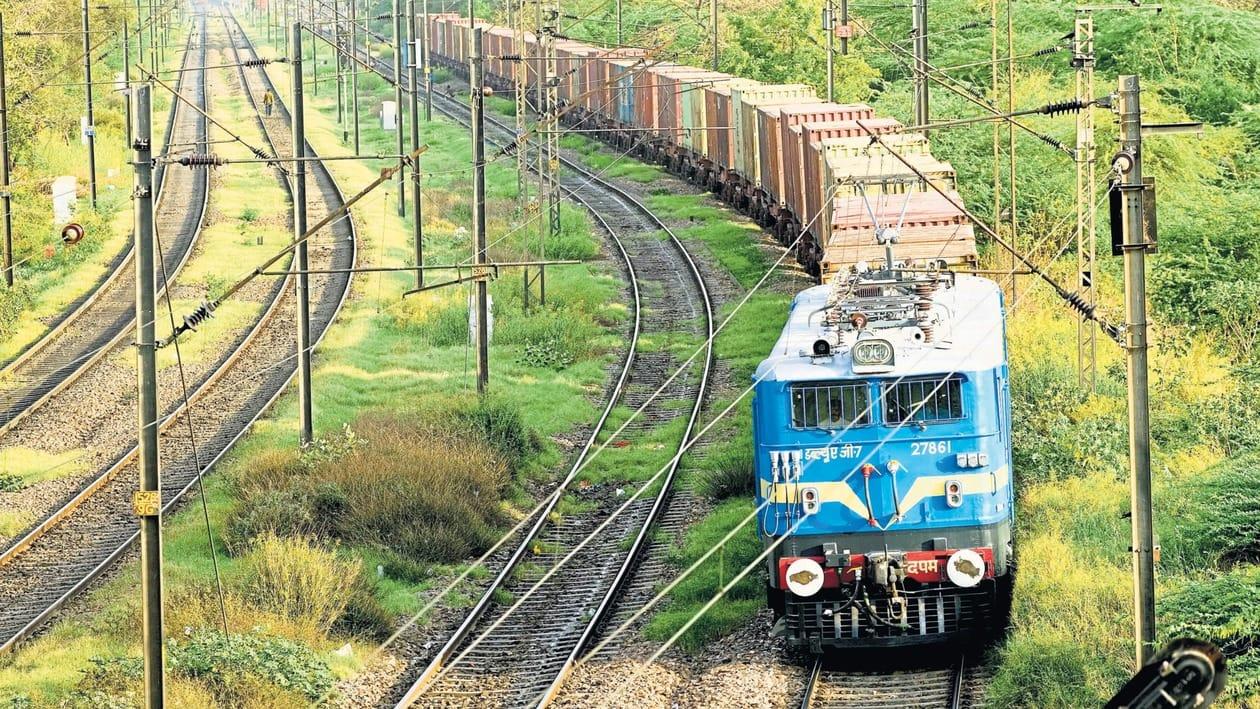

Railway stocks have been performing well on Dalal Street for some time now, owing to robust September-quarter earnings and strong order inflows with ongoing transformation in the railway sector.

"The main reasons for the railway PSU pack to surge are that the government plans to monetise land, increase freight corridors that are generating a higher amount of demand, and also give independent status to these PSUs to run the operations under independent professional management," said Deven Choksey, Managing Director of KRChoksey.

In the last three months, the stock has climbed from 33.60 apiece to its current level of Rs. 66.70, generating a fabulous return of 98.51 percent. The stock's 52-week high and low levels were ₹84.10 and ₹29, respectively. Taking the current price into account, the stock rose 130 percent from its one-year low.

The stock began its upward rally on October 20, after it bagged an order worth ₹484 crore for the development of Kharicut Canal (between Naroda Smashan Gruh & Vinzol Vehla) in AMC Area Package 2 and 3. Since then, it has gained nearly 86.57 percent.

Earlier, on September 29, Rail Vikas Nigam said that it secured a contract for the construction of a 4-lane highway from Samarlakota to Achampeta Junction (for 12.25 km) by the National Highways Authority of India (NHAI) as a part of Kakinada port to NH-16 connectivity in the State of Andhra Pradesh under Bharatmala Pariyojana on EPC mode at a total awarded cost of ₹408 crore.

For the September quarter, the company posted a net profit of ₹381.2 crore, a growth of 36.53 percent compared to a net profit of ₹279.2 crore. The revenue from operations came in at ₹5,130.8, an increase of 25.70 percent YoY.

Rail Vikas Nigam Limited is a Category-I Mini-Ratna CPSE under the Ministry of Railways.

The company is engaged in the business of executing and implementing all types of rail infrastructure projects, including new lines, doubling (including 3rd and 4th lines), gauge conversion, railway electrification, metro projects, more.

3 analysts polled by MintGenie on average have a 'strong buy' call on the stock.

Disclaimer: The views and recommendations made above are those of individual analysts or broking companies, and not of MintGenie.