To be able to ace the world of personal finance and investments, it is advised to follow the investing lessons shared by legends in the field such as Warren Buffett or Dennis Gartman. Each one of them including George Soros, Charlie Munger and Prashant Jain had a unique view on investments and their success speaks volumes about their characteristic style.

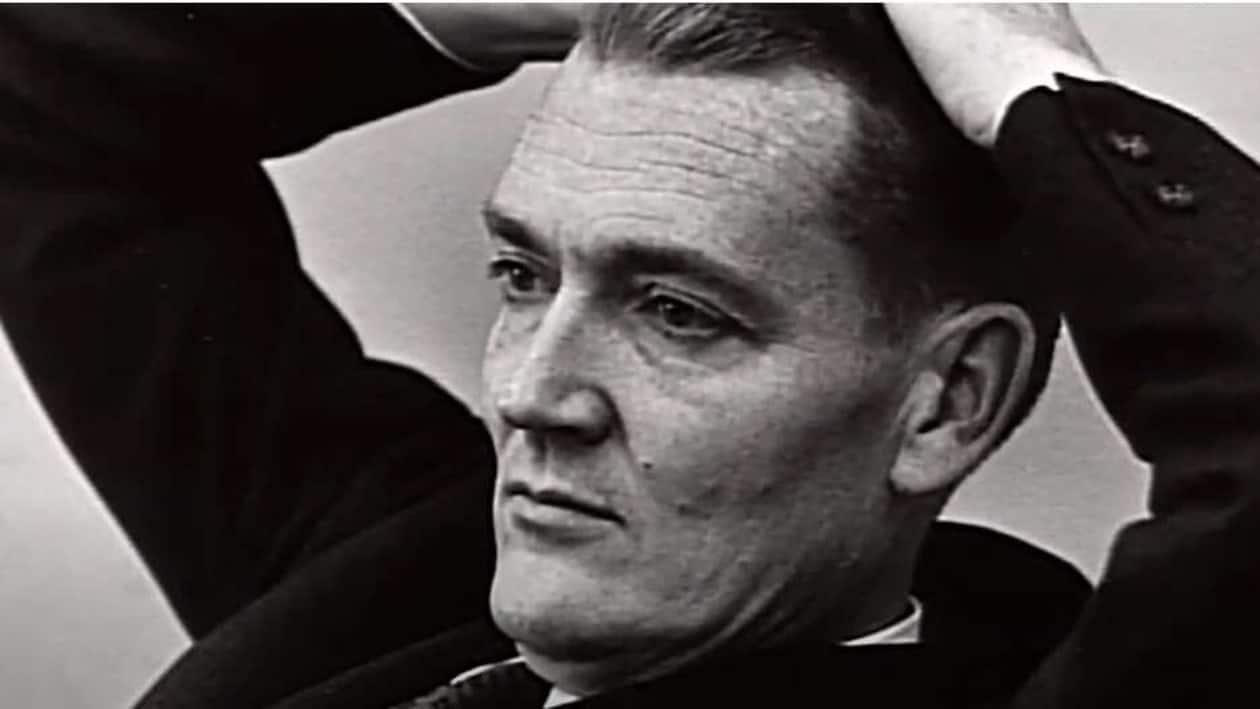

In this article, we shed light on one of the doyens finance: John Clifton Bogle who was a US investor and the founder of Vanguard Group. He is also credited with creating the first index mutual fund: Vanguard S&P 500 Index Fund.

The ace investor advocated investment over speculation, long-term patience over short-term action, and also endorsed cutting down broker fees. According to Bogle, the ideal investment vehicle was a low-cost index fund which is held over a lifetime with dividends reinvested and bought with dollar cost averaging.

These are the money lessons one can learn from him:

1. Say no to not investing: The risk one faces from investment is not only short-term fluctuation but not being able to earn sufficient return on capital in the long term.

Needless to mention that investing gives highest returns when started at a young age. The modest returns one makes at a young age is likely to grow to huge amount over the course of lifetime.

2. Stay away from short term temptations: It is important that you keep your emotions away from investment regime. It's not wise to act impulsively on a popular opinion that is shared by millions.

3. Reverting to the mean: An extraordinary performance by a mutual fund will most likely revert to the average returns posted by the market and sometimes even below it.

4. Stay simple and straight forward: Fundamental investment is very simple. It entails allocation among stocks, debt instruments and cash. Often times, investment is seen as a complex form of study whereas in reality - it is not. So, follow Bogle's advice and stay simple in terms of your investment style.

5. Stay the course: Notwithstanding the crusts and troughs of market, it is vital to stick to your investment discipline. Altering the investment strategy at the wrong time can be one of the most disastrous mistakes. So, no matter what happens, just stay the course.

6. Investment expenses: It is imperative to keep the investment expenses low because the compounding works not only in returns but in expenses as well.