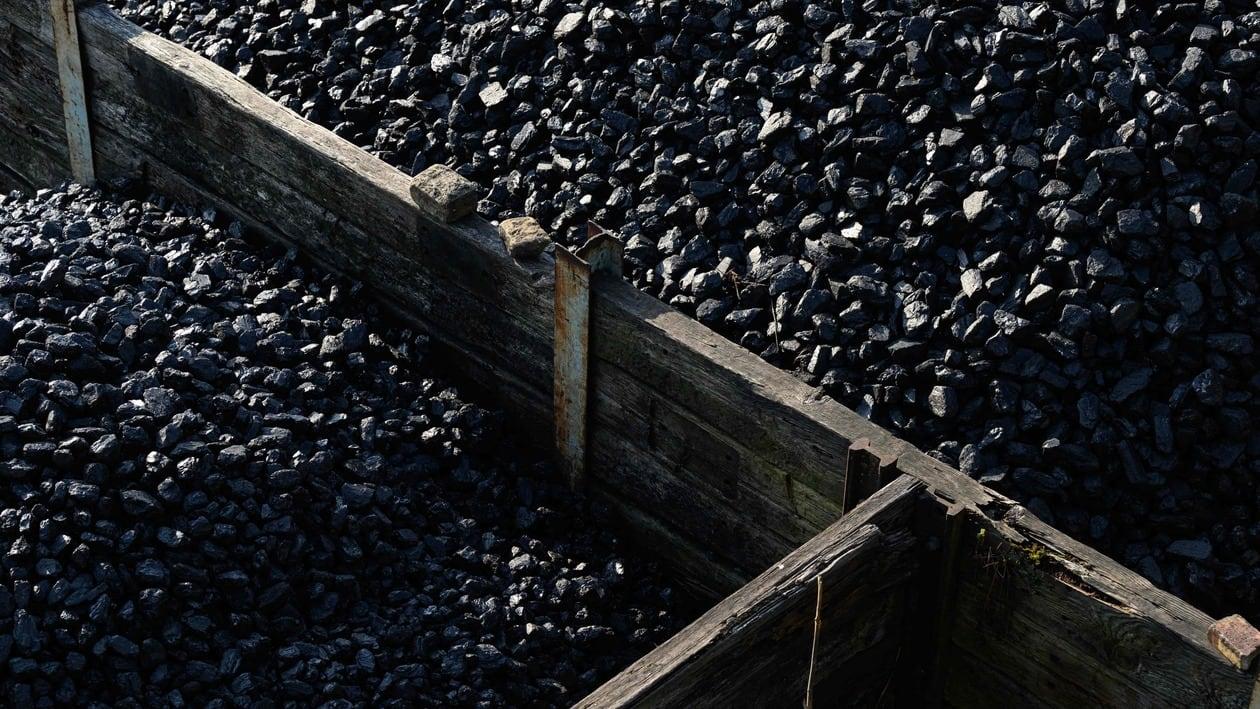

Coal India is an Indian government-owned coal mining and refining corporation with a market cap of ₹1,15,920. CIL is the single largest coal-producing company in the world and one of the largest corporate employers. The company operates in 85 mining areas spread over eight provincial states of India, its website shows.

Coal India has been an outperformer so far in 2022. In the last one year, the stock has outperformed by gaining 27.75 per cent, as compared to a 0.83 per cent rise in the Nifty50.

The stock has rallied 28.15% so far this year. The stock gained by 42.18 per cent from its 52-week low of ₹132.8. and with Wednesday's closing price of Rs.188.75, the stock is 11.17% away from its 52-week high, which it had previously touched on April 22, 2022.

However, over a 3-year period, the stock gave a negative return of 25.63% as compared to the Nifty50, which generated a return of 34%.

On the technical front, the stock is trading higher than the 5-day, 10-day, 20-day, 30-day, 50-day, 100-day, and 200-day moving averages.

It has a P/E of 6.70, which is on the lower side compared to the sector P/E of 7.39. The EPS stands at Rs. 28.17. The company has almost emerged as a debt-free entity.

The company has a robust financial risk profile with healthy net cash and cash equivalents of ₹25,870 Cr as of March 2022. Trade receivables have come down to ₹11,368 Cr in FY22 from ₹19,623 Cr in FY21, leading to positive free cash flow in FY22 (post working capital changes).

The company has a Capex plan of ₹17,000 Cr for FY23, primarily on evacuation infrastructure. Despite the proposed Capex and high dividend payout, liquidity will remain robust over the medium term, backed by a robust capital structure and healthy cash accrual. At CMP, the current dividend yield remains attractive at 11%, according to Axis Securities.

Meanwhile, the company has a rich dividend history. It has declared 20 dividends since February 11, 2011.

Axis Securities has maintained a 'BUY' recommendation on the stock with a target price of ₹225, representing a 19.68 per cent upside potential from the last traded price of ₹188.75.

Coal India reported a consolidated net profit of ₹6,692.94 crore in the March quarter, up 45.91 per cent year on year (YoY) from ₹4,586.78 crore in the same quarter last year.

Revenue from operations was ₹32,706.77 crore in the March quarter, up 22.5 per cent year on year from ₹26,700.14 crore in the same quarter last year.

The promoters hold 66.13 per cent of the shares in the company, while foreign institutions raised their stake to 6.9 per cent in the March quarter from 6.51% in March 2021. Mutual funds hold 9.6 per cent of the shares, and regular shareholders own 5.06 per cent.

An average of 23 analysts polled by MintGenie have a 'buy' call on the stock.

Disclaimer: The views and recommendations made above are those of individual analysts or broking companies, and not of MintGenie.