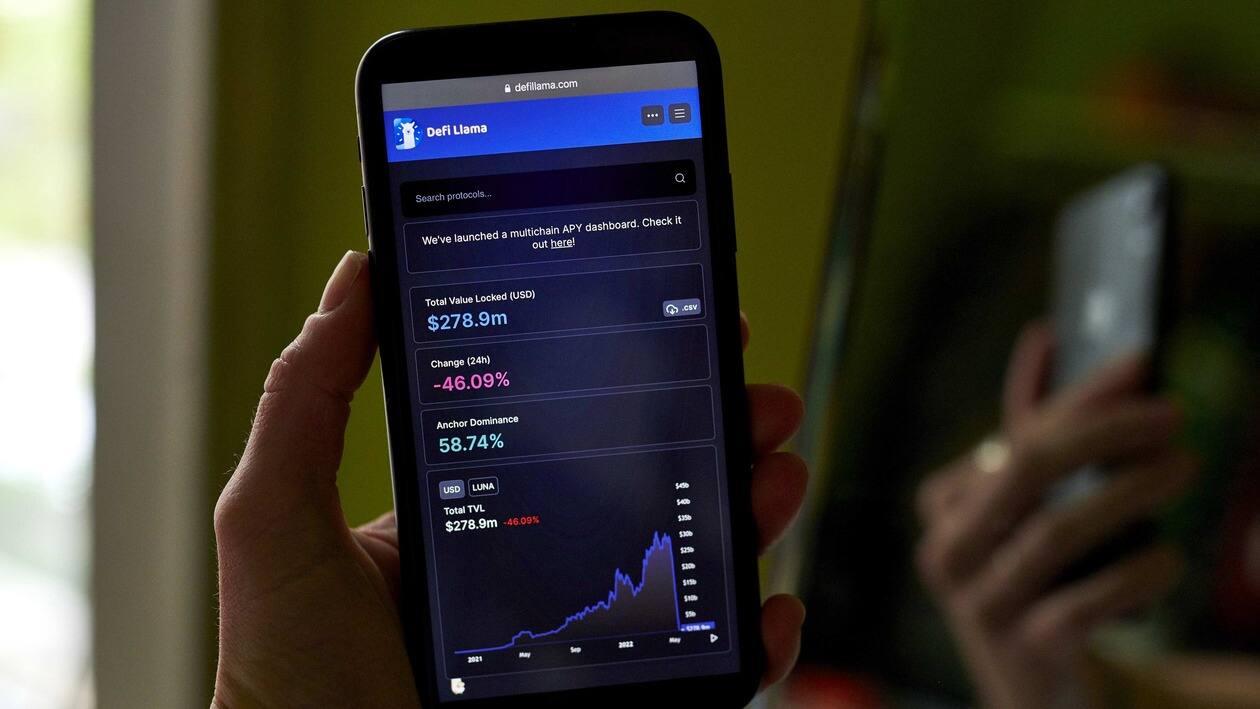

The Year 2020 was called the Year of the DeFi. It marked the ending of the crypto winter which began with the ICO bubble burst of 2017. Barely two years into the crypto summer induced by the DeFi epoch of the CryptoSaga, we witness the key metric indicator for the DeFi segment, the TVL, or the Total Value Locked, down by more than 50% from its peak achieved in November 2021. Is this the bubble bursting?

Let us understand DeFi in a few words – DeFi stands for Decentralised Finance. Decentralisation in Finance brings about a better economics for the incumbents as the smart contracts replaces the Centralised Financial Institutions as a low cost, automated execution agents and also the escrow mechanism built around it providing a means to avoid counterparty risk, avoiding the high legal costs undertaken by the financial institutions in servicing their clients.

The savings on such costs are redistributed among the participants and also the risk is redistributed among the protocol participants. As a concept, it is an efficient one and has witnessed some extraordinary efforts launched over the smart contract platforms – beginning with the Maker DAO. Technological and process evolution has made the protocols better and better and resulted in a proliferation of investments in these projects.

The type of solutions offered over these projects have also proliferated immensely in this short span of time, we have witnessed the launch of stablecoins, borrowing and lending platforms, decentralised exchanges with Autonomous Market Makers and Liquidity pools, Yield farming protocols, Insurance protocols, derivatives and margin trading protocols, alternate savings, staking and payments protocols to name a few.

Powered with community governance and DAOs, these projects concentrated on community building and infrastructure development. However, these important aspects did not scale up in sync with the investment flow and project launches. As a result of which, one important component of Decentralised protocols – “decentralisation” suffered.

Also, in some of the protocols, the smart contract security was not upto the mark, hence it suffered from cyber attacks like honeypot attacks, vulnerability exploits, scams etc. The total value lost to such attacks is estimated at $4.75 billion, of which only 21% or about $1billion have been recovered.

The REKT Database, which maintains an account of such attacks recorded 2,872 attacks of which the most vulnerable attacks were recorded as honeypot, exit scams, exploits, access control and flash loan. The major areas of problems are Token vulnerabilities and Protocol vulnerabilities.

In addition to monetary losses, these events seriously damage the investor confidence and in turn, the entire ecosystem. The problem requires the protocols to undertake some measures like smart contract audits, penetration tests and bug bounties conducted by some reputed and experienced market players. Such a service will bring back the confidence of the investors in the DeFi protocols and will go a long way in proliferating the decentralised financial ecosystem.

Ajoy Pathak is a Blockchain Evangelist with CryptoWire, a first port of call for entry into blockchain and cryptocurrencies. CryptoWire seeks to empower participants of the crypto universe with its super app and its research, training and information platforms like Crypto University, CryptoTV and CryptoWire.