Gen Z is different and more unique than its predecessors, the millenials, due to their inclusive outlook, willingness to learn new things, and persistent hunt for challenges. As a result, they have larger expectations than previous generations, particularly in terms of their careers. In order to comprehend what money means to the members of this generation Z in a growing world, this series explores students and young working professionals and their perspectives on money and finance.

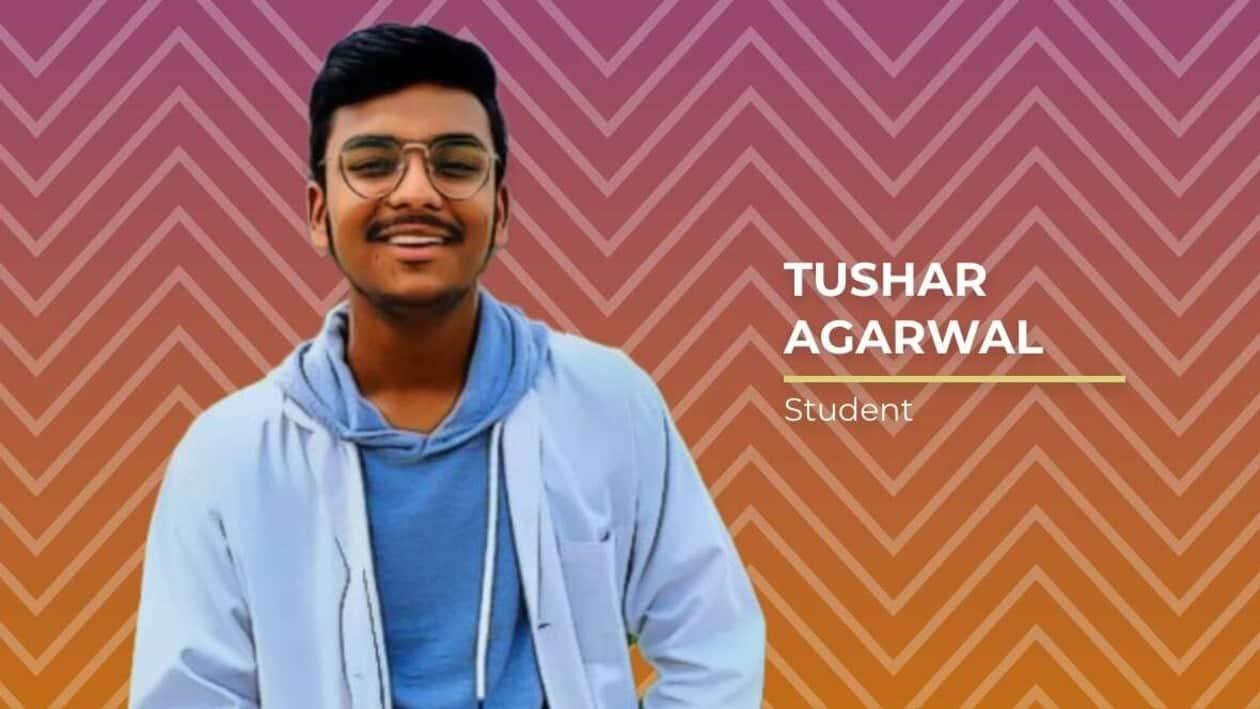

Tushar Agarwal of Nims University, Jaipur, Rajasthan tells MintGenie in an interview that saving money is crucial, especially in these times, to maintain financial control and guarantee both your present and future financial well-being. He is currently pursuing a bachelor’s degree in physiotherapy. His main hobbies outside of this are playing sports like football, skating, and swimming and listening to music.

Edited Excerpts:

What does money mean to you? Is it the most important factor when it comes to your life decisions like what to study, career and so forth?

Money is a very important factor that affects our lifestyle in every way. Yes, money is crucial when it comes to education since without it, we wouldn't be able to select any subject or college we desired. The importance of money can be observed by how when it comes to careers, most individuals choose to give up their favourite fields in favour of those that pay them more.

What do you spend your money on every month at the moment? Can you give a breakup in percentage terms?

As I live in a hostel, my accomodation is covered under my college fees. Apart from that, I spend my money on shopping and eating out each month. I spend approximately half of it on purchasing necessities, 30 percent on food, around 18 percent on everyday costs like transportation, and the remaining portion is usually saved.

What are the things you want to spend money on?

If I had enough money, I would love to spend it on anything and everything that would improve my life. Besides that, I love spending money on foods, dress, accessories, shoes and would want to explore places around my city.

Do you save money? If yes, how frequently and what do you do with this money?

Yes, I do save money. Saving money is crucial, especially in these times, to maintain financial control and guarantee both your present and future financial well-being. I save money once in a month and with this money I'm planing to invest in stocks.

What does having a job mean to you? What are the top two factors you will want to think about when deciding a company to work for?

My employment is a location where I may discover my potential and develop every day. Having a job means having an active income that I can utilise for my necessities as well as to start investing and creating my own passive income to live the life I want. The first thing I would look for in a job is if it will allow me to use my ability and obtain valuable knowledge and experience. The second thing is whether I'll receive adequate money for the work I do.

What do you think about investing your money? If you have a certain amount of money set aside, will you want to invest it in the stock market, mutual funds, or do you just keep it in your bank savings account?

People close to me have frequently remarked that while exploring the stock market when you are young is a terrific idea, it is also crucial that you have a basic understanding of it before you begin. Despite what those close to you may tell you about the benefits of investing, you should only do so after carefully researching the financial instrument. If I have a certain amount of money set aside, I will want to invest it in the stock market.

Do you think you have an understanding on how to save and invest? If yes, how did you learn? If not, are you trying to learn?

I think investing is a great method to make your money work hard for you and increase your wealth. I know the basics of saving, but I'm not sure what the ideal investing strategy is. I learned a little about investing via YouTube, and I'm eager to learn and explore more about modes of investing.

Do you follow social media influencers and follow their investment advice?

There are lot of people on social media who look out every opportunity to give out advice on every topic. However, the majority of them are just ambiguous or base their opinions on their own experiences. I do, meanwhile, follow several professionals on social media who are certified to give advice on finance and investment, and follow their advice.

Do you talk to your mother or your father about money and learn from them or follow their advice?

Yes, I talk to my father about money and investments, and he also offers advice since he is the first person I turn to when I have questions about finances. I tend to base all of my important life decisions—not just financial ones—on my parents' recommendations.