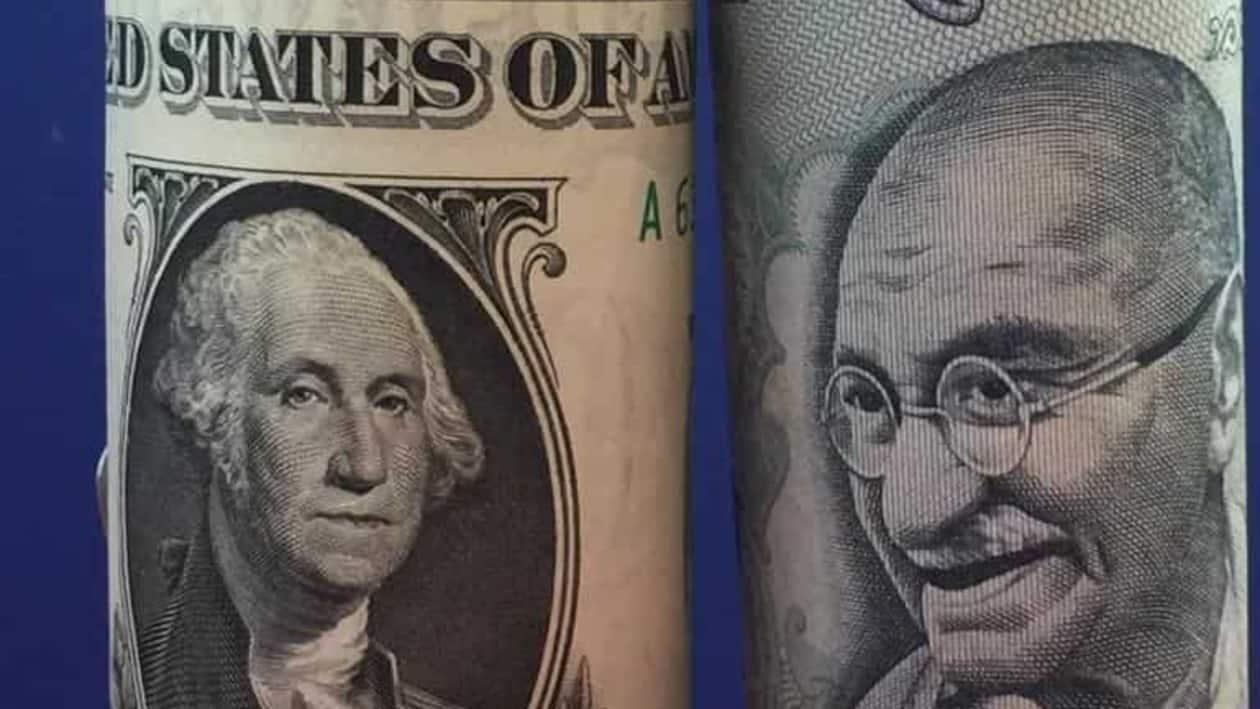

Liberalized remittance scheme (LRS) was introduced in India in 2004 by the Reserve Bank of India (RBI). It is a scheme that enables Indian residents to remit funds abroad for certain specified purposes. The scheme has been one of the most important instruments for promoting international trade and investment, as well as for facilitating capital flows into and out of India.

Prior to this, the Foreign Exchange Management Act (FEMA) 1999 had imposed several restrictions on the transfer of funds from India to other countries. Under the new scheme, individuals were allowed to remit up to USD 25,000 per financial year for eligible transactions. The amount was subsequently increased to USD 50,000 in 2007 and further increased to USD 250,000 in 2013.

The primary objective of the liberalized remittance scheme is to liberalize the existing foreign exchange regulations and facilitate the smooth transfer of funds abroad by Indian residents. The scheme also aims to promote and encourage non-residents to invest in India and promote outward remittances from India.

Who can avail the benefits under this scheme?

In order to avail the benefit of the LRS, the individual must be an Indian resident as defined under the Foreign Exchange Management Act (FEMA). He/she must also have a valid PAN card, a bank account in India, and a valid passport. Further, the amount to be remitted should not exceed the prescribed limit of USD 250,000 per financial year.

The scheme permits Indian citizens resident in India to remit up to USD 250,000 per financial year (April-March) for any permissible current or capital account transaction or a combination of both. This amount can be used for business, personal, educational, and other purposes.

What are the benefits of liberalized remittance scheme?

One of the major advantages of the scheme is that it enables individuals to make investments in international financial markets without having to go through the cumbersome process of obtaining permission from the RBI. This helps them to diversify their investment portfolios and get access to a wider range of financial instruments.

The scheme also provides an avenue for Indians to transfer funds to their family members or friends who are residing abroad. This is especially useful when there is an emergency situation where funds are needed urgently.

The scheme also opens an opportunity for non-resident Indians (NRIs) to transfer funds to their relatives in India. This can be done without any restrictions, making it easier for NRIs to maintain contact with their family members back home.

Are there any limitations of the liberalized remittance scheme?

Although the liberalized remittance scheme (LRS) has several advantages, it is subject to certain restrictions and limitations. These include:

- The maximum amount that can be remitted in a financial year is USD 2,50,000. Any amount exceeding this limit requires prior permission from RBI.

- Remittances under the scheme are not permitted for certain activities such as real estate, the purchase of lottery tickets, margin trading, and speculation in foreign exchange markets.

- The recipient of the funds must be a person resident outside India and must be eligible to receive funds from India as per the foreign exchange regulations of the country concerned.

The liberalized remittance scheme is one of the most important instruments for promoting international trade and investment, as well as for facilitating capital flows into and out of India. It allows Indian residents to remit funds abroad for various specified purposes without any restrictions or prior approval from the RBI.

However, the scheme is subject to certain eligibility criteria and documents requirement. Thus, it is important to understand all the rules and regulations before availing the benefit of the scheme.