Shares of Coal India have been on a bull run since start of the year, with the stock returning 70% to date. During Wednesday's intra-day trade, the stock reached a three-year high after the company reported robust September quarter numbers. On BSE, the stock opened strong at ₹255.50, then gained further to hit a 3-year high of Rs. 263.40, registering a rise of 5.54% over its previous closing price. At the current market price of ₹258, the stock is trading 86% higher than its 52-week low of ₹139.2.

In Q2 the company reported impressive Year-on-Year growth in net profit on the back of higher coal prices and an uptick in demand. Coal India reported a 106% rise in its consolidated profit at ₹6,043.99 crore for the September-ending quarter as against a net profit of ₹2,932.72 crore in a similar period.

Coal India's revenue from operations during the July-September period of this fiscal jumped to ₹29,838.07 crore compared to ₹23,291.08 crore in the year-ago period. While the total expenses increased to ₹23,770.12 crore from ₹20,424.52 crore in Q2 FY22. Its EBITDA margin improved to 24.40% in Q2 compared to 16.93% in Q2 of FY22, an expansion of nearly 743 basis points.

Coal prices began to rise as soon as the conflict between Russia and Ukraine erupted in February, benefiting coal India, as domestic buyers rushed to buy coal from the company as international prices skyrocketed. Additionally, as India is heavily dependent on coal-based power generation, the increase in heatwave in some areas of the country between April and May caused a surge in power demand, pushing coal production to record highs.

During the second quarter of FY23, coal production rose to 139.228 million tonnes (MT) from 125.83 MT in the corresponding quarter of FY22. The coal offtake during the quarter also went up to 154.533 MT from 147.434 MT in the corresponding quarter of the previous fiscal.

During Q2, Coal India’s total supply of coal through the fuel supply agreements (FSA) was 141.64 million tonnes (MT) from 118.03 MT in the similar period. The average realisation per tonne from the FSA sales in Q2 was ₹1,413.75 compared to ₹1,381.75 in Q2 FY22. The realisation through e-auction sales during Q2 FY23 came in at ₹6,061.51 per tonne, compared to ₹1,593.36 per tonne in Q2 FY22.

For the period of H1CY23, coal production jumped to 351.9 million tonnes (MT), an increase of 17.4% compared to 299.6 MT in the period of the fiscal. In addition, coal output by the company in the current financial year is expected to be 700 MT, and there would be an additional 200 MT of output from other sources.

Earlier, Coal Minister Pralhad Joshi said that Coal India will achieve one billion tonnes of coal production target by 2025–26 as opposed to the earlier timeline of 2023–24 in view of the COVID-19 pandemic, PTI reported.

Meanwhile, the company declared an interim dividend of ₹15 per share and fixed November 16 as the record date.

In terms of financial ratios, Coal India has one of the highest Return on equity among Nifty 50 companies. The company delivered an ROE of 40.23% in the year ending March 31, 2022. The 5-year average ROE and ROcE stood at 45% and 21.38%, respectively.

In its equity report dated October 4, ICICI Securities has given a "buy" call on the stock with a target price of ₹294. The brokerage expects dependence on domestic coal will remain strong and e-auction premiums to remain elevated in FY23, which is likely to result in a better FY23, both in terms of volumes and prices. Additionally, any reduction in diesel prices is expected to help lower costs, it added.

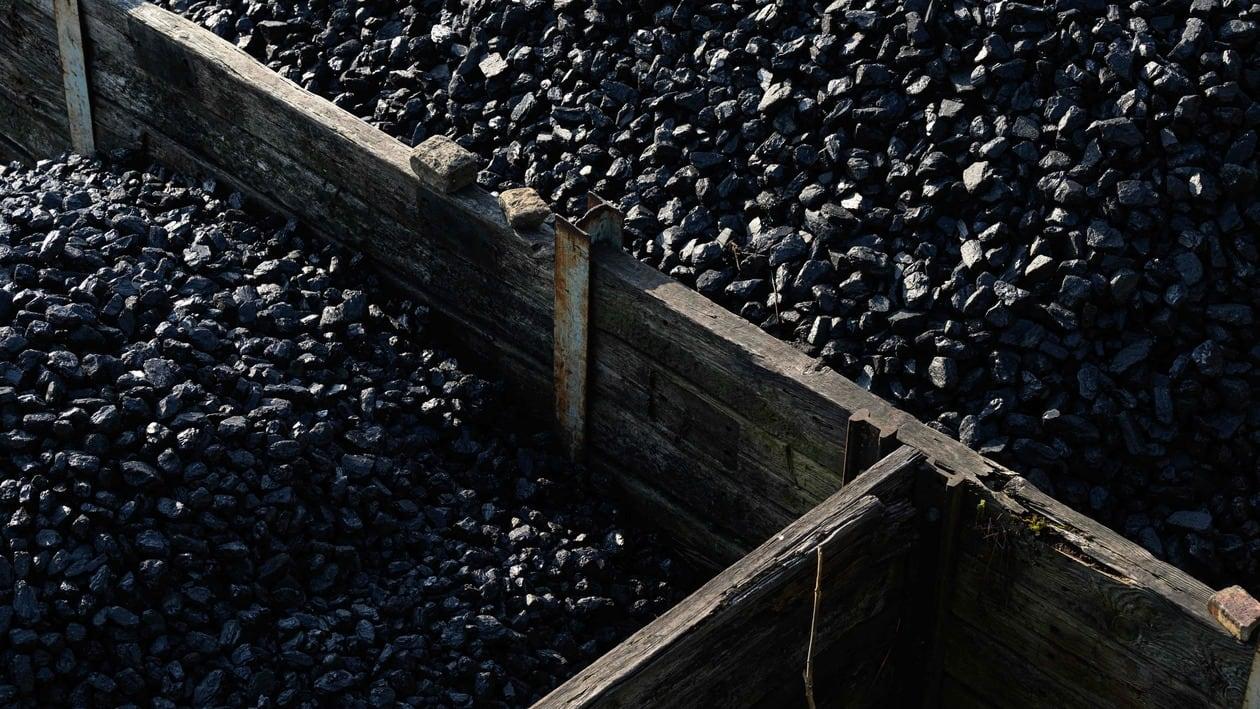

Coal India Ltd. (CIL) is a "Maharatna" public sector undertaking under the Ministry of Coal, Government of India. The company is the single largest coal-producing company in the world and one of the largest corporate employers. CIL accounts for over 80 per cent of the domestic coal output.

The company produces non-coking coal and coking coal of various grades for diverse applications. Most of the coal produced is from open-cast mines. Coal India's major consumers are the power and steel sectors. Others include cement, fertilizer, brick kilns, and a host of other industries. The company sells substantially all of the raw coal it produces in the Indian market.

An average of 22 analysts polled by MintGenie have a 'buy' call on the stock.

Disclaimer: The views and recommendations made above are those of individual analysts or broking companies, and not of MintGenie.