Indian and global markets alike jumped on Monday as a weekend deal by US President Joe Biden and House Speaker Kevin McCarthy to suspend the government’s debt ceiling provided relief for investors.

After weeks of negotiations, congressional Republican McCarthy and Biden agreed on Saturday to avert an economically destabilising default by suspending the $31.4 trillion debt ceiling until 2025. The deal now has to clear a narrowly divided Congress before the United States runs out of money to pay its debts in early June, reported Reuters.

The Indian market rose almost a percent on the back of this news. It is now just a kissing distance away from its peak, hit in December 2022.

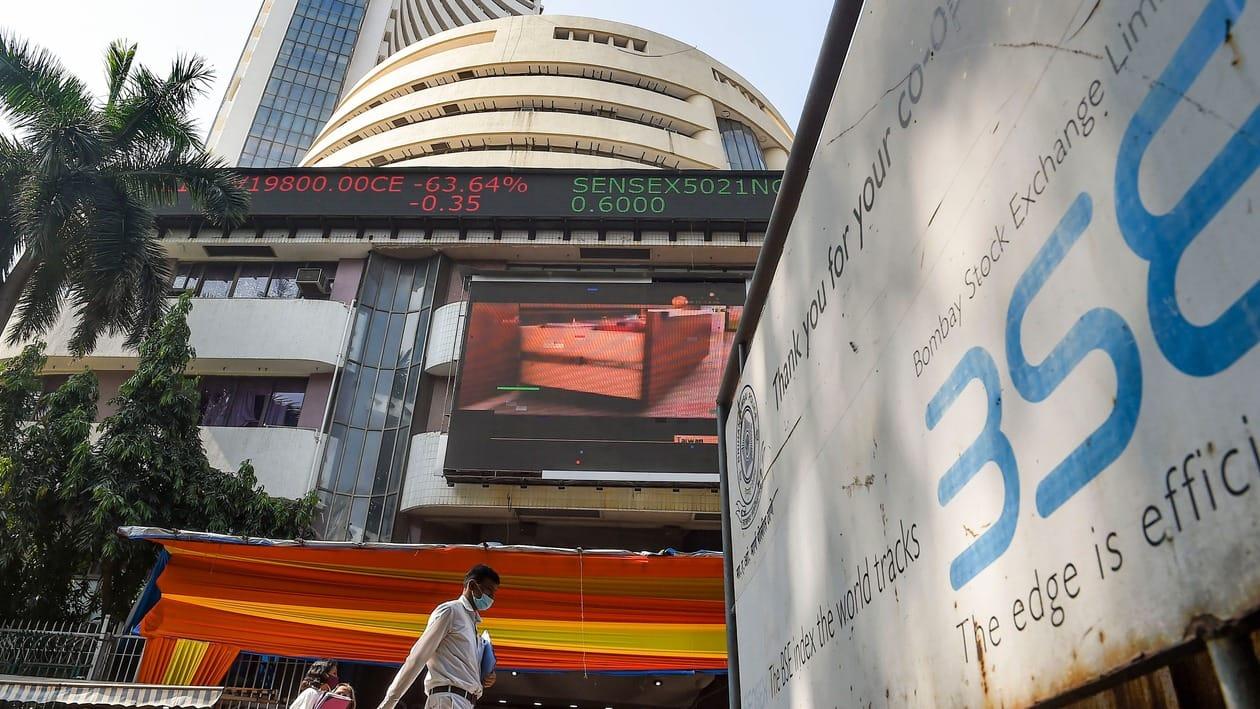

The BSE Sensex rose as much as 0.8 percent or 524 points to its day's high of 63,026 on Monday. It is now just 0.08 percent away from its all-time high of 63,583.07.

Meanwhile, the Nifty50 rose 0.76 percent or 142 points to its day's high of 18,641.20. It is now 1.3 percent away from its peak of 18,887.60.

But how does this impact the Indian market? Let's find out.

VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services, noted that the ‘in principle’ deal on the US debt ceiling is a near-term relief to stock markets and, therefore, can aid the continuation of the ongoing rally which can take Nifty to new record highs.

"Sustained FPI inflows and positive macroeconomic trends like FY23 GDP expected at 7.1 percent, CPI inflation (April CPI inflation is 4.7 percent) coming within RBI’s comfort zone, and sustained buoyancy in tax collections can provide the fundamental support to the rally. But it is important to appreciate the fact that at higher market levels, valuations will be difficult to justify and this can attract selling pressure," said the expert. He believes that IT largecaps have been witnessing value buying and there is some more room for ups in this segment. Financials and autos are also on a strong wicket, he advised.

Meanwhile, Sunil Damania, Chief Investment Officer, MarketsMojo, said, "The world market was watching the US debt ceiling negotiation with eagle eyes, as not reaching a consensus could have unprecedented consequences for the world economy. Fortunately, common sense prevailed, as it did in 2011, and a compromise formula has been negotiated in which the debt ceiling limit has been suspended for 2 years. This is a huge relief for global equity and debt markets. The compromise formula will lift sentiments temporarily for investors across the world, but the market will eventually return to the fundamentals of inflation, interest rates, and other macro factors."

Technical outlook

"We are at the doorstep of the 18,660 objective, which we have been aiming for, all through last week. But, the steepness of Friday’s rise, as well as proximity to the record peak of 18,887, prompt us to be guarded against potential rejection trades. We prefer to play this scenario by riding on the upside momentum early on, with downside risk markers placed at 18,430 initially, to be trained to any of 18,535, 18,660, or 18,750, as we move higher and until 18,887 or 19,070 is achieved," forecasted Anand James, Chief Market Strategist at Geojit Financial Services.